Michael Hartnett of Bank of America Advises on Stock Market Strategy Amid Fed Rate Cuts

Overview of Hartnett's Insights

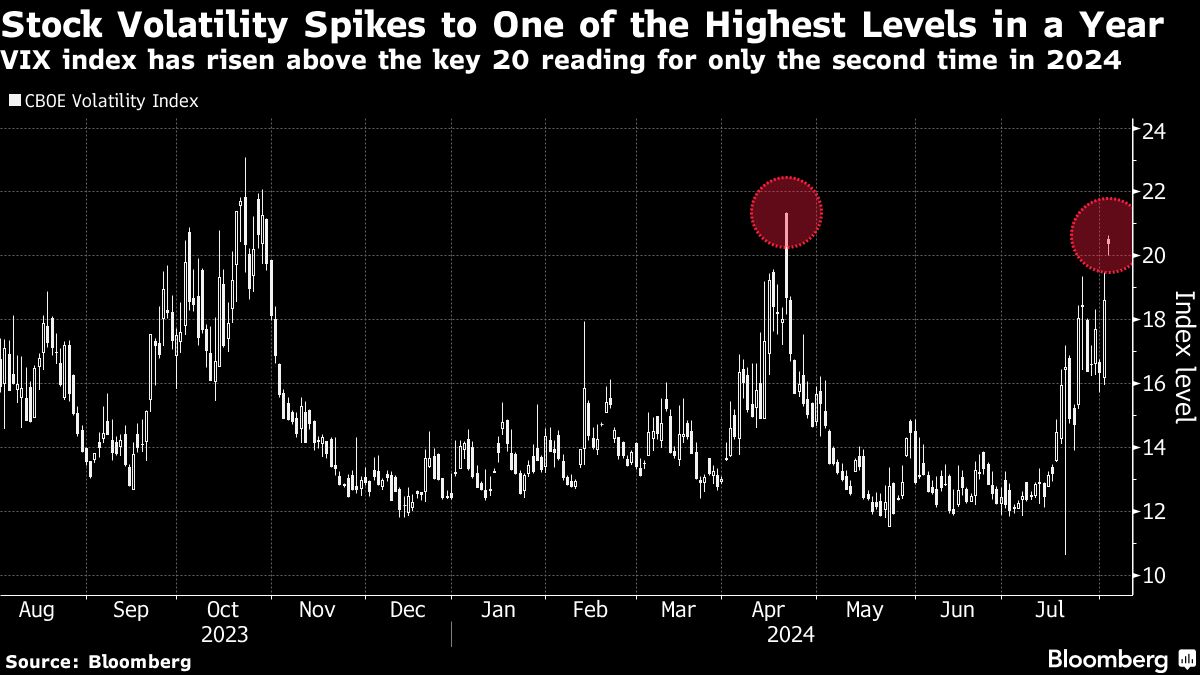

Bank of America Corp.'s Michael Hartnett warns that investors may face significant risks in the stock market as the Federal Reserve initiates its first interest-rate cut. This decision is expected to be influenced by economic data suggesting a hard landing rather than an easy transition.

Key Points to Consider

- First rate cut by the Fed signals changing economic conditions.

- Indicators suggest a potential hard landing for the US economy.

- Hartnett advises a cautious approach to stock investments.

Conclusion

As the Fed marks a significant policy shift, it’s crucial for investors to reassess their strategies. The implication of a hard landing suggests a need for heightened awareness in market positioning.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.