Calculate Your Mortgage Costs Amid Interest Rate Changes

Introduction

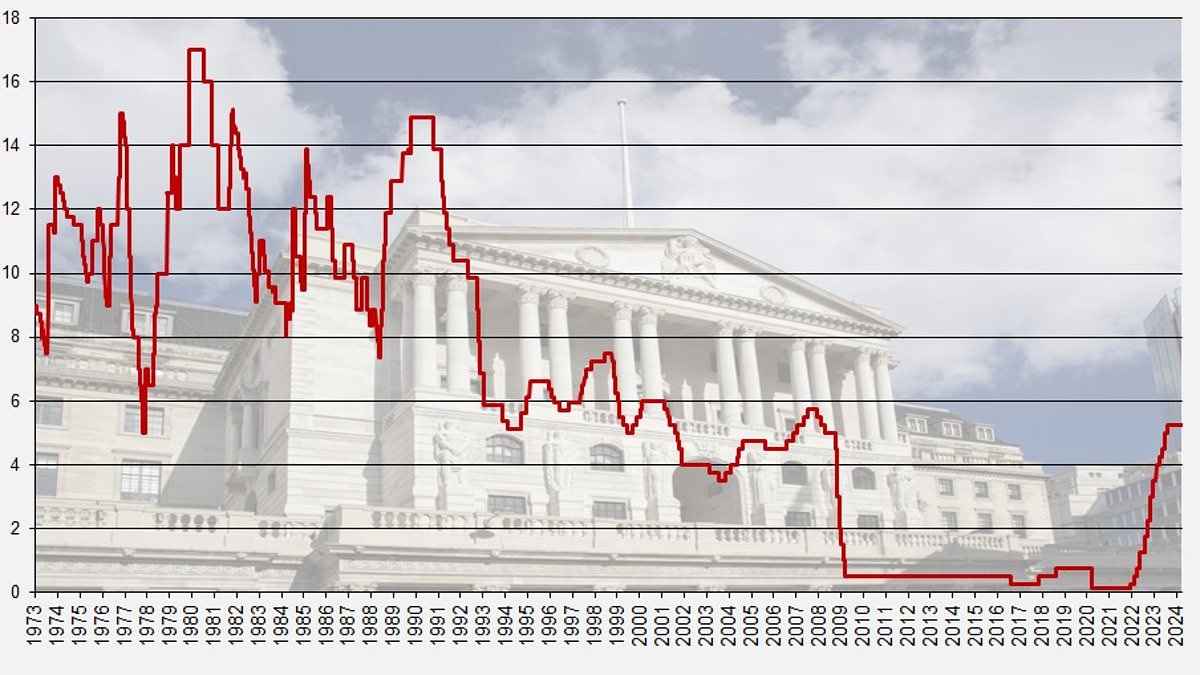

The Bank of England has recently reduced interest rates to 5%, which significantly influences mortgage costs.

Impact of Interest Rate Changes

With our mortgage calculator, you can analyze the potential financial implications of both rising and falling interest rates. Here’s what you need to consider:

- Calculating monthly payments: Adjusted for rate fluctuations.

- Understanding overall costs: How rate changes can affect your long-term mortgage payments.

- Strategic planning: Importance of assessing your mortgage options regularly.

Conclusion

In conclusion, being aware of how interest rates impact your mortgage can lead to better financial decisions. Utilize our calculator to stay ahead and ensure you are prepared for any market changes.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.