The Case for Dividend Total Return Stocks over AI Investments

Investing Strategies for Today's Market

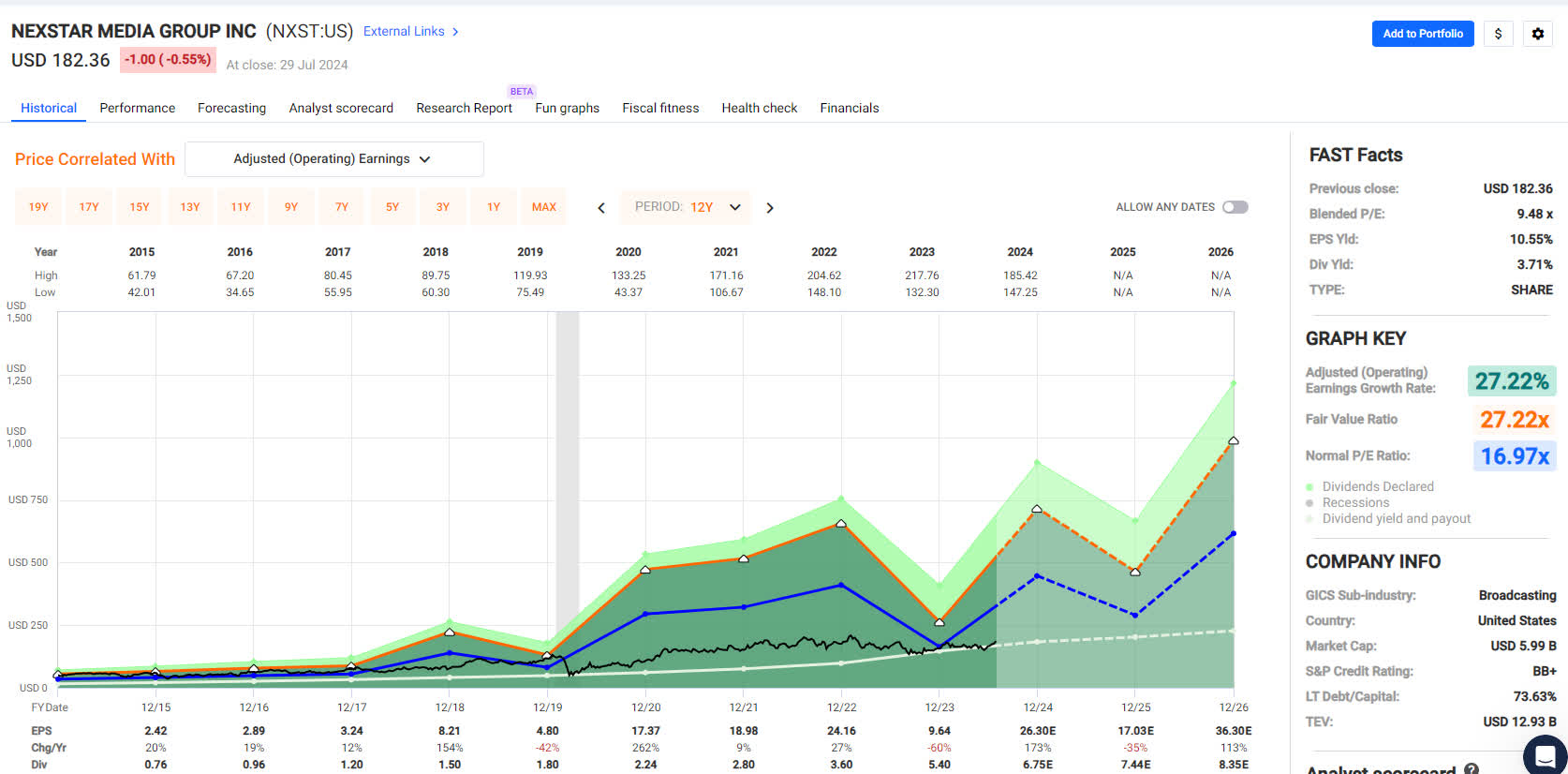

In light of recent market trends, many investors are considering where to place their dollars. While the allure of AI stocks is undeniable, focusing on dividend total return stocks may offer better risk-adjusted returns.

The Importance of Diversification

- Dividend stocks provide a steady income source.

- Historically, they have outperformed speculative tech stocks.

- During market downturns, dividends can cushion portfolio losses.

Conclusion

Investing in strong dividend-paying companies offers stability and growth potential. As we analyze the investment landscape, it is clear that prioritizing these stocks will help mitigate risks associated with current market volatility.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.