FOMC's Current Stance on Interest Rates and Future Implications

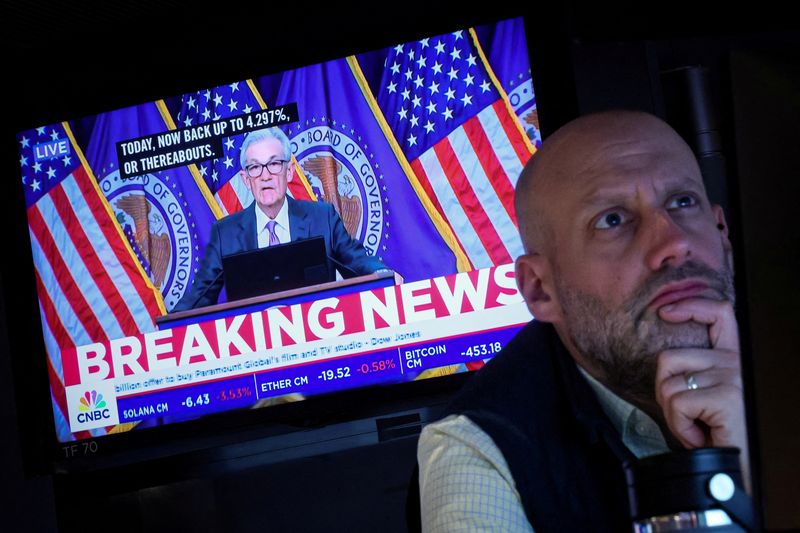

FOMC Meeting Overview

The Federal Open Market Committee (FOMC) recently held a two-day policy meeting where they made critical decisions regarding the U.S. economy.

Current Interest Rates Maintained

- The benchmark overnight interest rate remains unchanged in the range of 5.25%-5.50%.

Inflation Assessment Changes

The FOMC's assessment of inflation has shifted:

- Inflation is now described as somewhat elevated.

- This contrasts with the previous characterization of inflation as elevated.

Implications for Future Rate Cuts

This change in inflation perspective suggests that the committee may be setting the stage for potential rate cuts in September, depending on further economic developments.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.