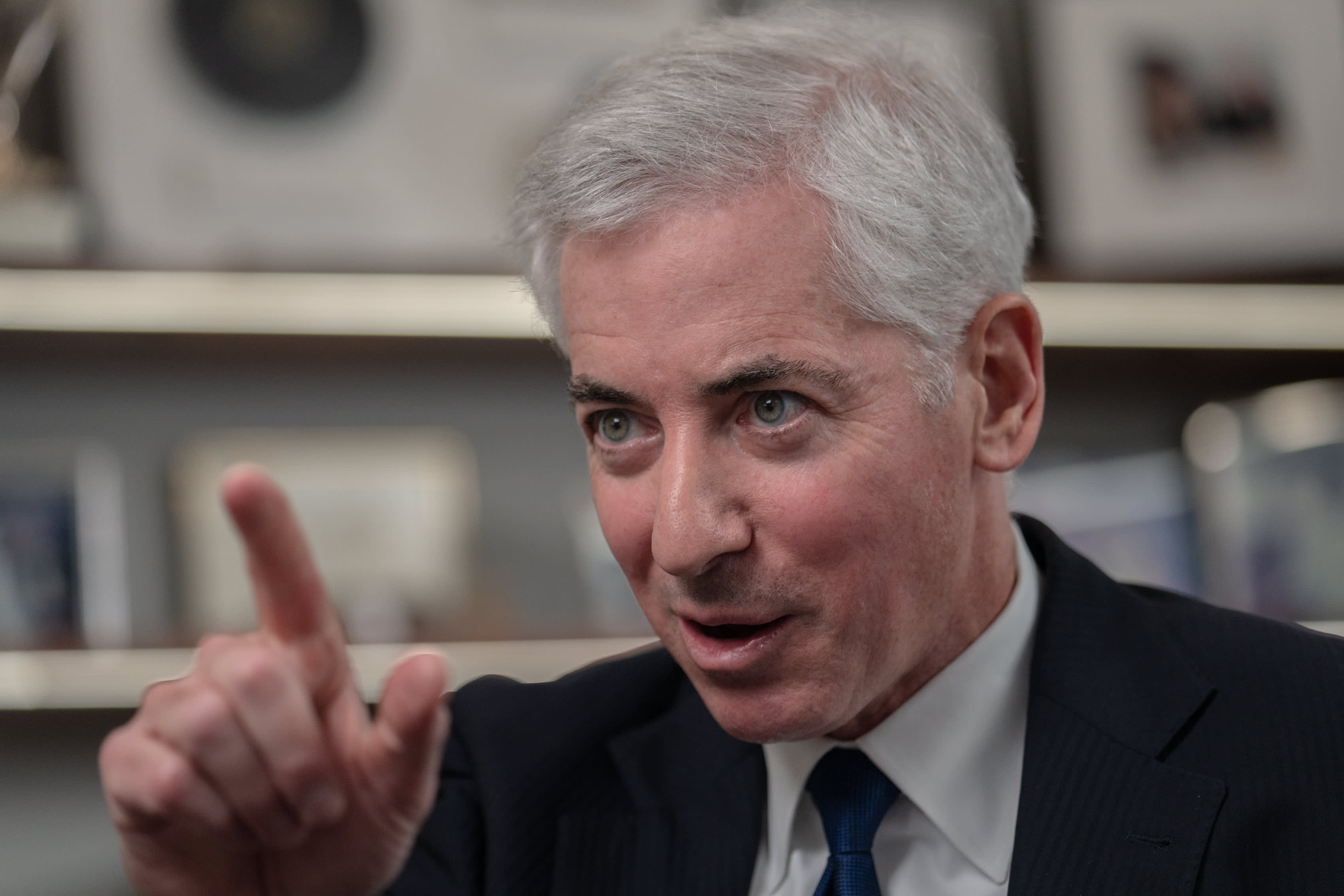

Bill Ackman’s Pershing Square Cancels IPO Amid Decreased Demand

Pershing Square Withdraws IPO

Bill Ackman's Pershing Square USA has halted its initial public offering plans after demand fell below original expectations. This decision demonstrates a notable shift in market dynamics and investor confidence.

Market Implications

- The withdrawal reflects a cautious investment landscape.

- Future fundraising efforts may face increased skepticism.

- Ongoing challenges could influence other IPOs in the pipeline.

Conclusion

The drop in interest for Pershing Square's IPO underscores a significant trend within the financial markets, indicating that investor sentiment remains delicate, and future offerings could encounter similar hurdles.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.