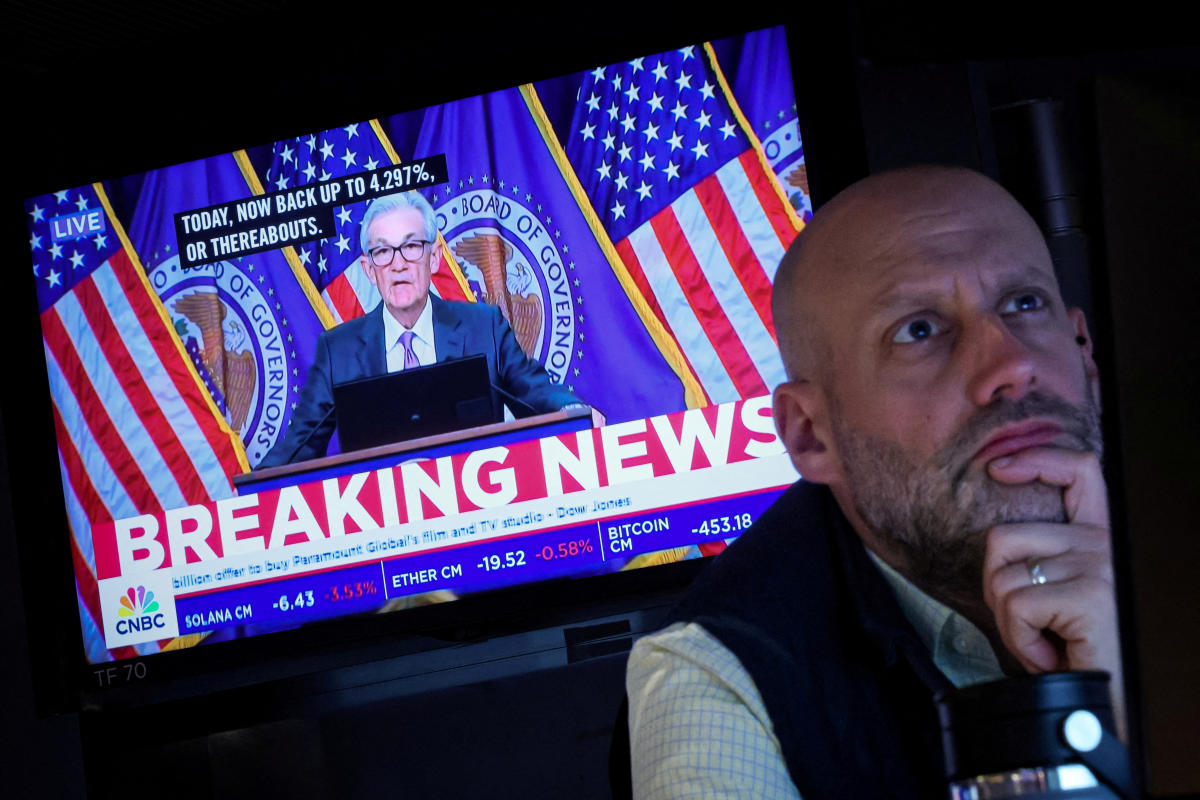

Federal Reserve Holds Rates Steady While Indicating Future Cuts

Federal Reserve Interest Rates Decision

The Federal Reserve opted to keep interest rates steady at a 23-year high during its recent meeting. This move aligns with their focus on managing inflation effectively.

Future Prospects for Rate Cuts

According to Fed officials, there is an open door for a September rate cut should inflation continue to show significant progress. This indicates a careful monitoring of economic indicators to ensure that monetary policy supports a stable economic environment.

- The current interest rate remains at a historic high.

- Future cuts hinge on inflation trends.

- The Fed is committed to supporting economic growth while controlling inflation.

In conclusion, the Fed's decision reflects a cautious approach to navigating the challenges of inflation while still being open to adjustments in interest rates that could benefit the economy.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.