Hedge Funds Acquire $875 Million BlockFi Claim Linked to FTX Debt

Hedge Funds and BlockFi Claim

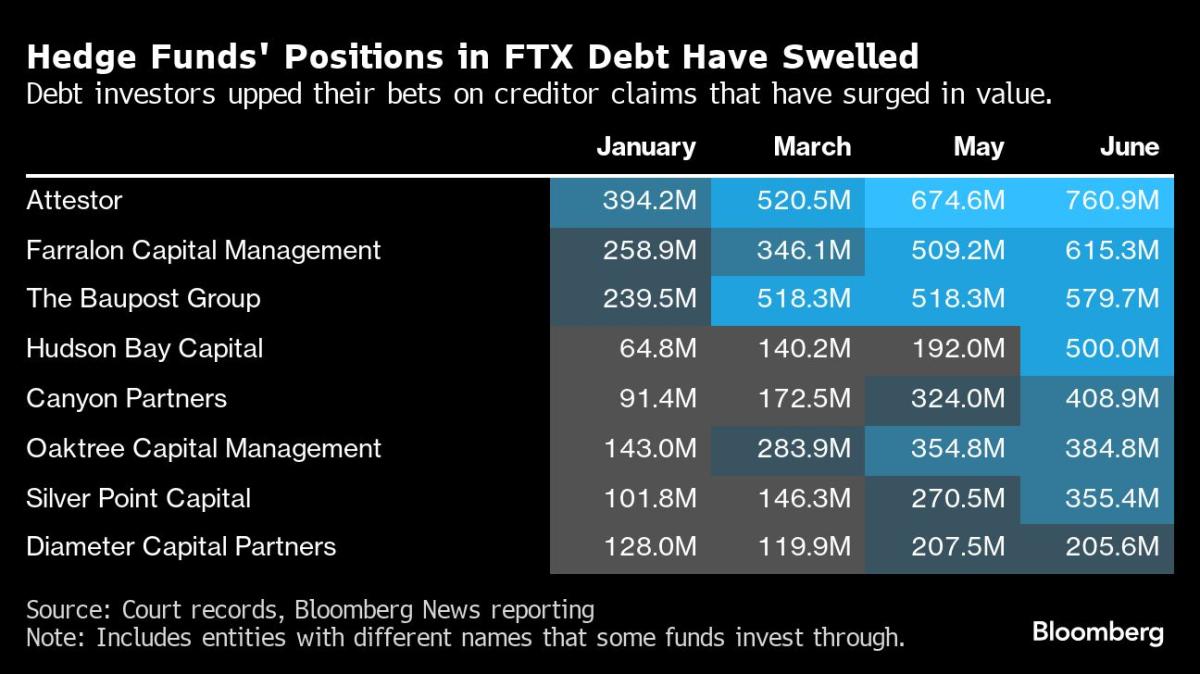

In an impressive development, several hedge funds have taken a bold step in the financial markets by acquiring a substantial claim against BlockFi Inc. This claim amounts to $874.5 million, linked to FTX's debt obligations.

Key Players Involved

Among the key players in this transaction are:

- Diameter Capital Partners

- Canyon Partners

- Farallon Capital Management

This acquisition signifies an important trend as it is the largest documented trade within the emerging market for debts tied to Sam Bankman-Fried's fraudulent exchange.

Market Implications

The surge of interest in distressed assets by various hedge funds showcases their strategy in navigating the complexities of the current financial landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.