Analyzing EURJPY: Market Dynamics Below the 100-day and 100-hour Moving Averages

Market Overview

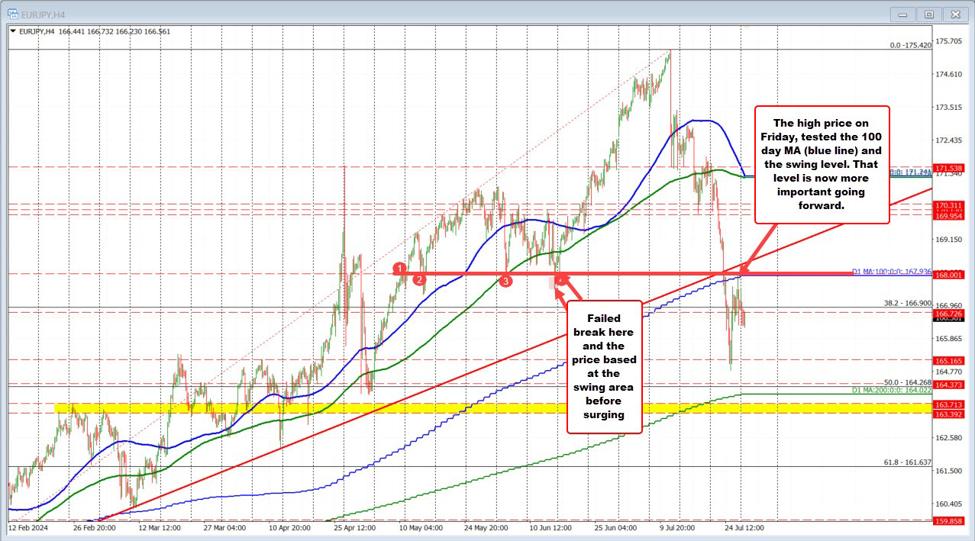

In the ever-evolving landscape of EURJPY trading, recent trends indicate that sellers have been leaning heavily against the market. Specifically, they have consistently remained below the 100-day MA and the 100-hour MA, which are critical indicators of market sentiment and activity.

Current Trading Dynamics

- Sellers' Position: The ongoing dominance of sellers is evident as they maintain positions below key moving averages.

- Market Sentiment: This bearish control suggests a lack of buyer strength in the market.

- Key Levels: Traders must monitor these moving averages closely for potential shifts in market direction.

Conclusion

As EURJPY remains under the pressure of sellers, understanding these pivotal levels will be integral for effective trading strategies. Market participants should remain vigilant in observing shifts that could signal a change in this trend.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.