Hasbro's Near-Term Expectations for Key Segments and Financial Performance

Current Stock Performance

Shares of Hasbro, Inc. (NASDAQ: HAS) have been performing well, remaining positive as of Monday. Over the past month, the stock has gained 11%.

Revenue Decline and Earnings Growth

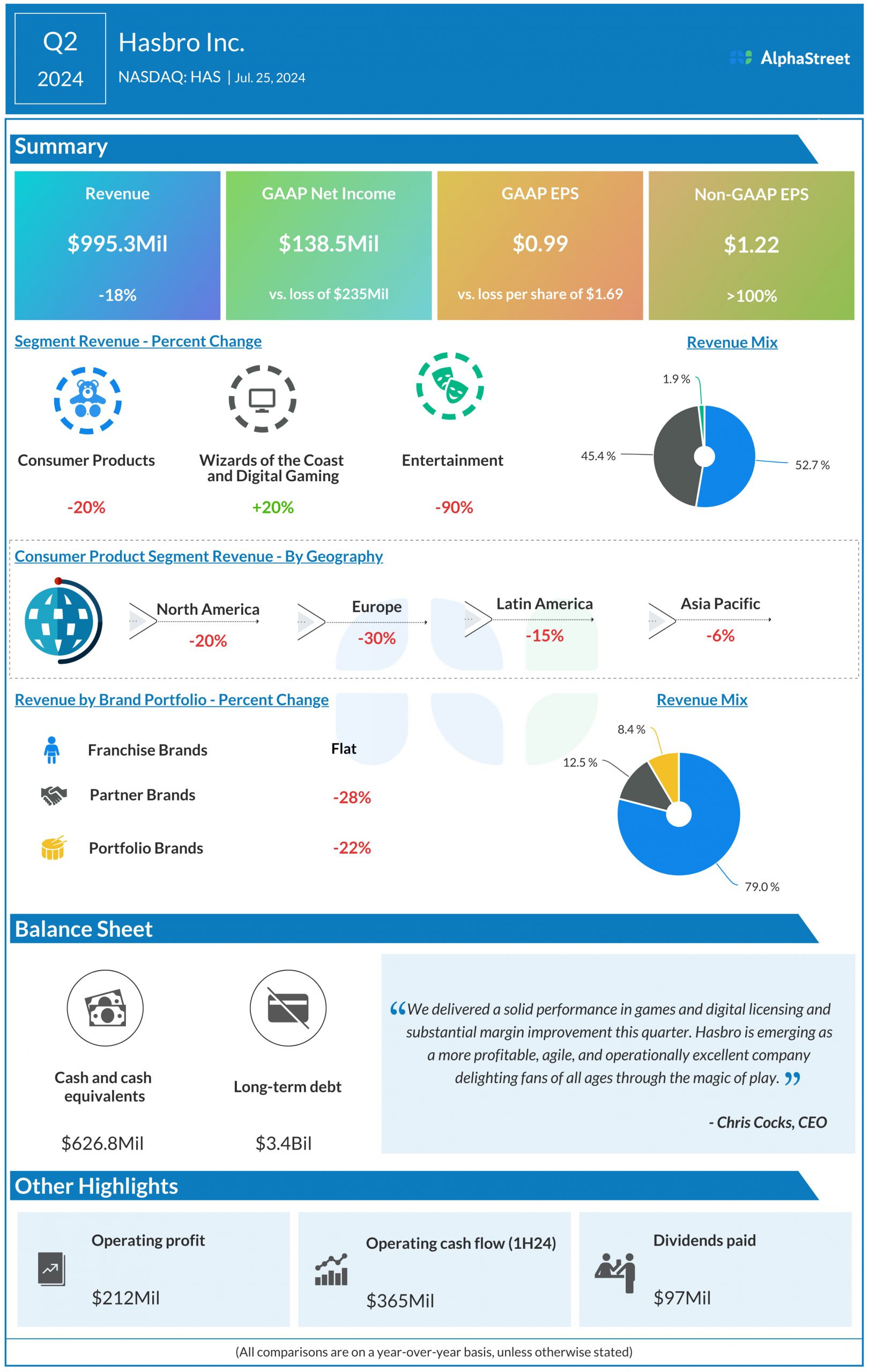

Despite the increasing stock price, Hasbro has faced challenges with a decline in revenue, showing double-digit decreases in the second quarter of 2024.

- The decline is mainly attributed to the eOne divestiture.

On a brighter note, adjusted earnings have seen a remarkable increase:

- More than doubled year-over-year.

- Driven by a favorable business mix and improved operations.

Conclusion

In summary, while Hasbro has encountered revenue challenges due to divestitures, its capability to increase adjusted earnings showcases resilience and operational improvements that may influence future segment expectations positively.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.