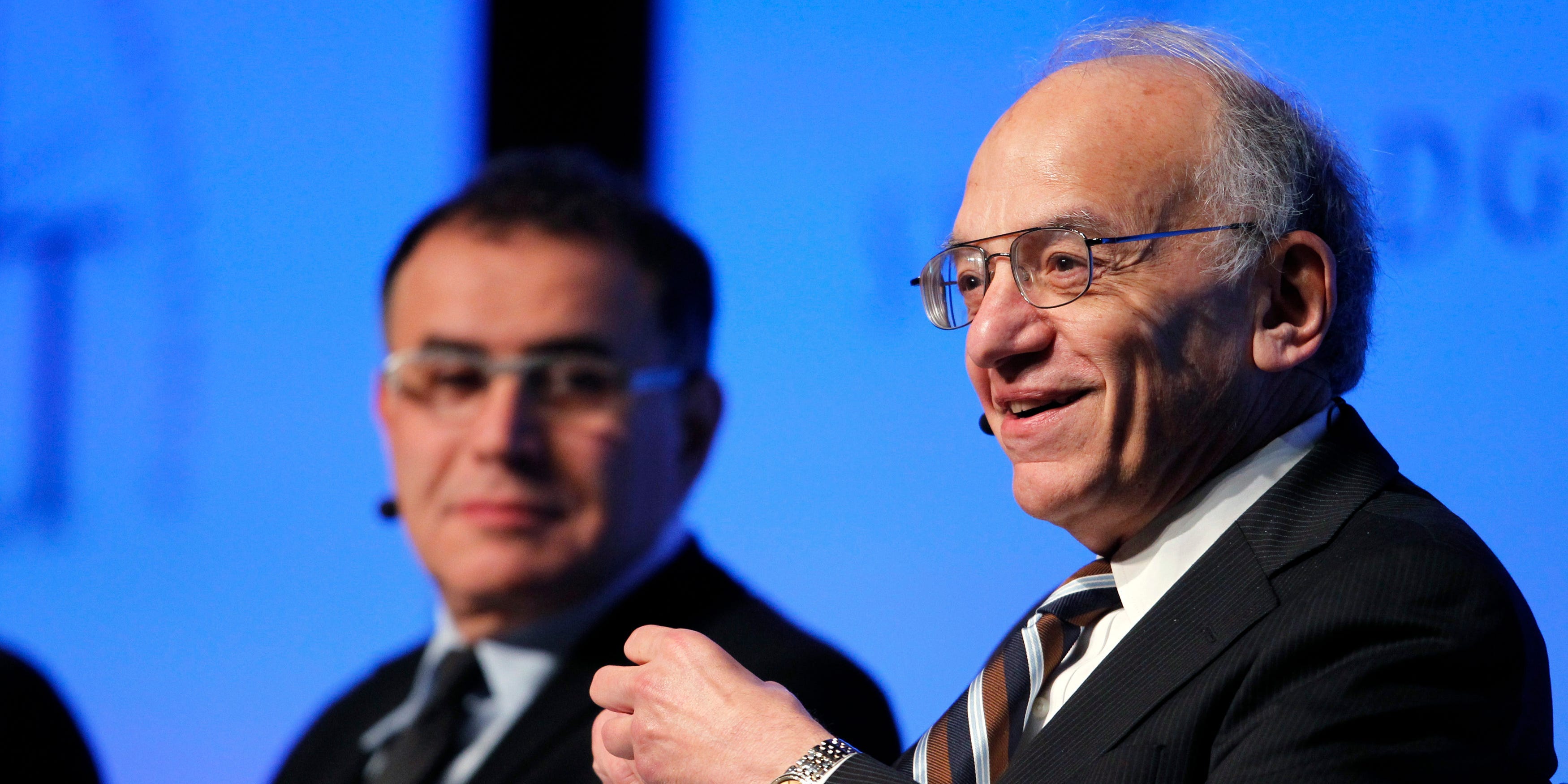

Upcoming Fed Rate Cuts Could Revitalize Value Stocks, According to Jeremy Siegel

Value Stocks Expected to Rebound

According to Wharton's Jeremy Siegel, a significant shift is on the horizon for value stocks.

Impact of Fed Rate Cuts

Siegel emphasized that a potential rate cut by the Federal Reserve in September could lead to a revival for these underperforming stocks.

- Value stocks could see a boost following rate adjustments.

- Historically, lower interest rates benefit value investments.

- This shift may mark a turning point in market trends.

Conclusion

With these insights, investors are encouraged to monitor upcoming economic changes closely, as the anticipated rate cuts could present profitable opportunities in the value segment of the market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.