Corporate Borrowers Accelerate Debt Market Activity Ahead of Central Bank Decisions

Monday, 29 July 2024, 15:29

Overview of Current Debt Market Trends

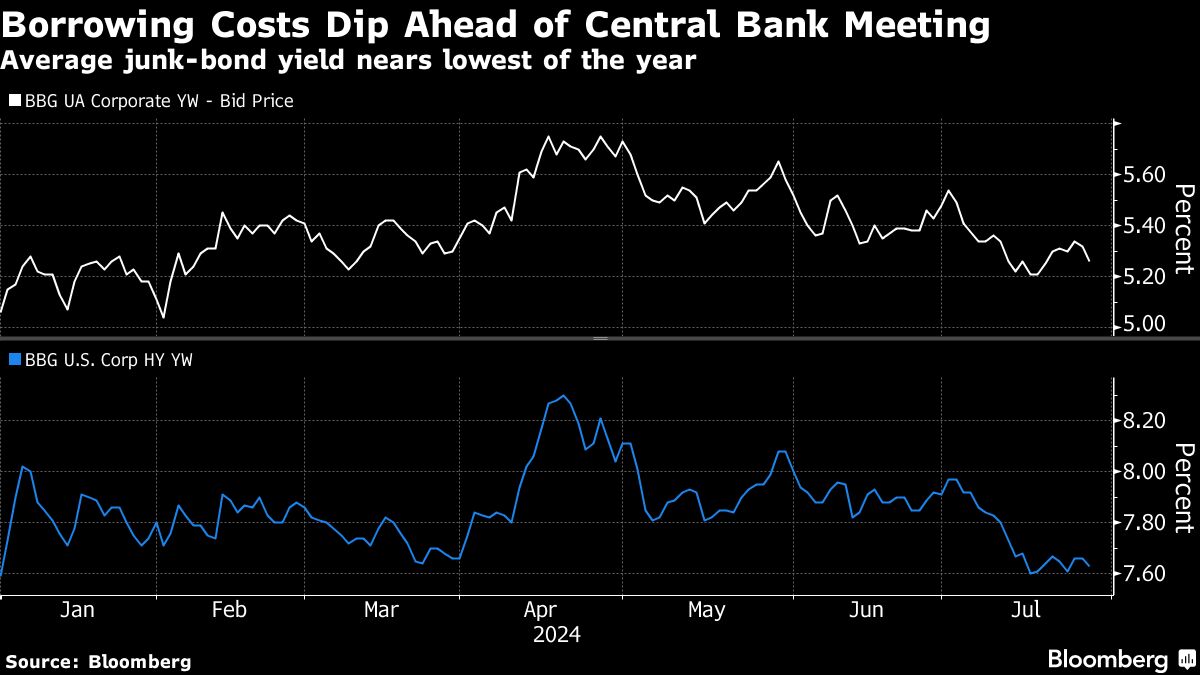

Corporate borrowers are rushing into debt markets to raise cash ahead of an impactful week of central bank meetings worldwide.

Key Highlights

- Increased Activity: A significant surge in new debt issuances has been observed as companies seek funds.

- Strategic Timing: Borrowers aim to capitalize on current market dynamics before important policy decisions.

- Global Impact: The outcomes of central bank meetings are likely to influence market conditions.

Conclusion

This proactive approach by corporate borrowers signals a response to anticipated changes in monetary policy, highlighting the importance of monitoring central bank actions closely.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.