Clarifying Dollar Depreciation and Devaluation: Key Insights

Understanding Dollar Depreciation

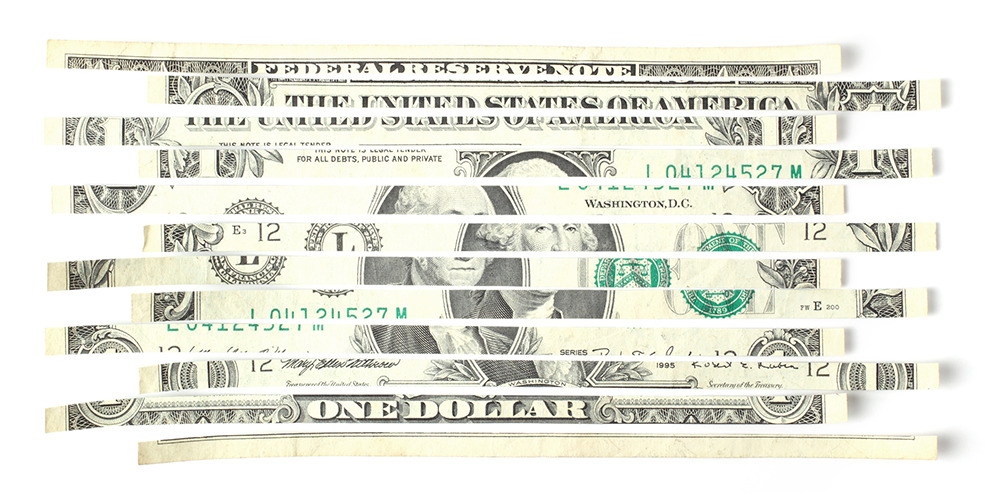

Dollar depreciation occurs when the value of the dollar declines in relation to other currencies due to market forces.

What is Devaluation?

Devaluation is a government decision to reduce the value of its currency deliberately, typically to enhance export competitiveness.

Implications for the Economy

- Dollar depreciation can lead to higher import costs, affecting inflation.

- Devaluation may boost exports but can also raise the cost of foreign debt.

Conclusion

Recognizing the difference between these two concepts is crucial for understanding foreign exchange markets and their impact on the global economy.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.