NVIDIA Corporation's Market Cap and Institutional Investor Perspectives

NVIDIA Corporation Market Cap Decline

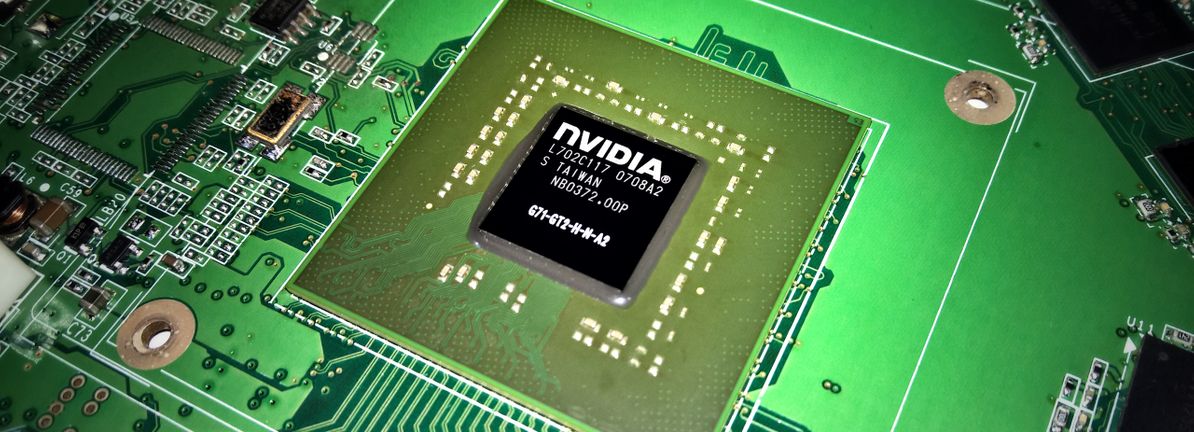

NVIDIA Corporation, a leading player in the tech industry, is currently facing a notable market cap decline of US$258 billion. This decline has raised questions about investor sentiment and the potential for a rebound.

Institutional Ownership Insights

- Significant institutional ownership indicates a strong influence on the stock price.

- The stock's performance is closely tied to trading activities among these major investors.

Long-Term Profit Outlook

- Despite recent losses, the longer-term profit potential of NVIDIA remains positive.

- Institutional investors continue to express optimism regarding the company's growth trajectory.

In conclusion, while NVIDIA's recent market cap decline is noteworthy, the strong institutional ownership and positive long-term outlook suggest that the company may still be positioned for recovery and growth in the tech sector.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.