Essential Strategies for Managing Debt and Maximizing Home-Based Tax Deductions

Strategies for Managing Debt

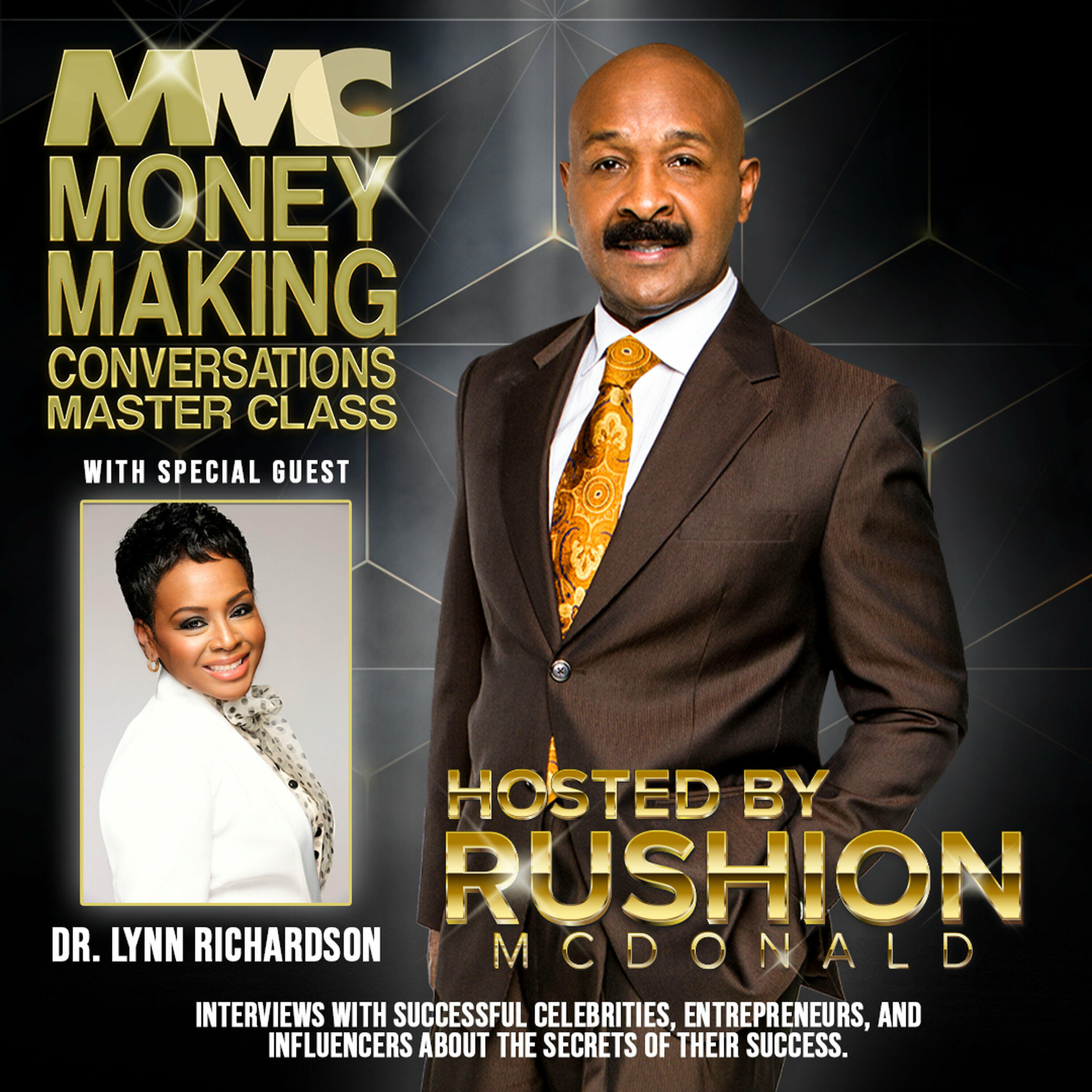

In her recent discussion with Rushion McDonald, Dr. Lynn Richardson highlights the importance of effective debt management. Here are some key strategies:

- Prioritize high-interest debts to alleviate financial pressure.

- Explore consolidation options to lower overall payments.

- Maintain consistent communication with creditors to negotiate better terms.

Tax Write-Offs for Home-Based Businesses

Dr. Richardson also emphasizes the benefits of understanding tax write-offs:

- Deduct home office expenses to reduce taxable income.

- Utilize vehicle expenses related to business use.

- Keep track of all eligible deductions and maintain thorough records.

Conclusion

Implementing these debt management strategies and leveraging home-based tax write-offs can lead to significant financial relief and greater efficiency for families navigating the complexities of today’s economy.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.