Why You Should Consider Buying Copper Stocks on a Price Dip

Monday, 29 July 2024, 07:02

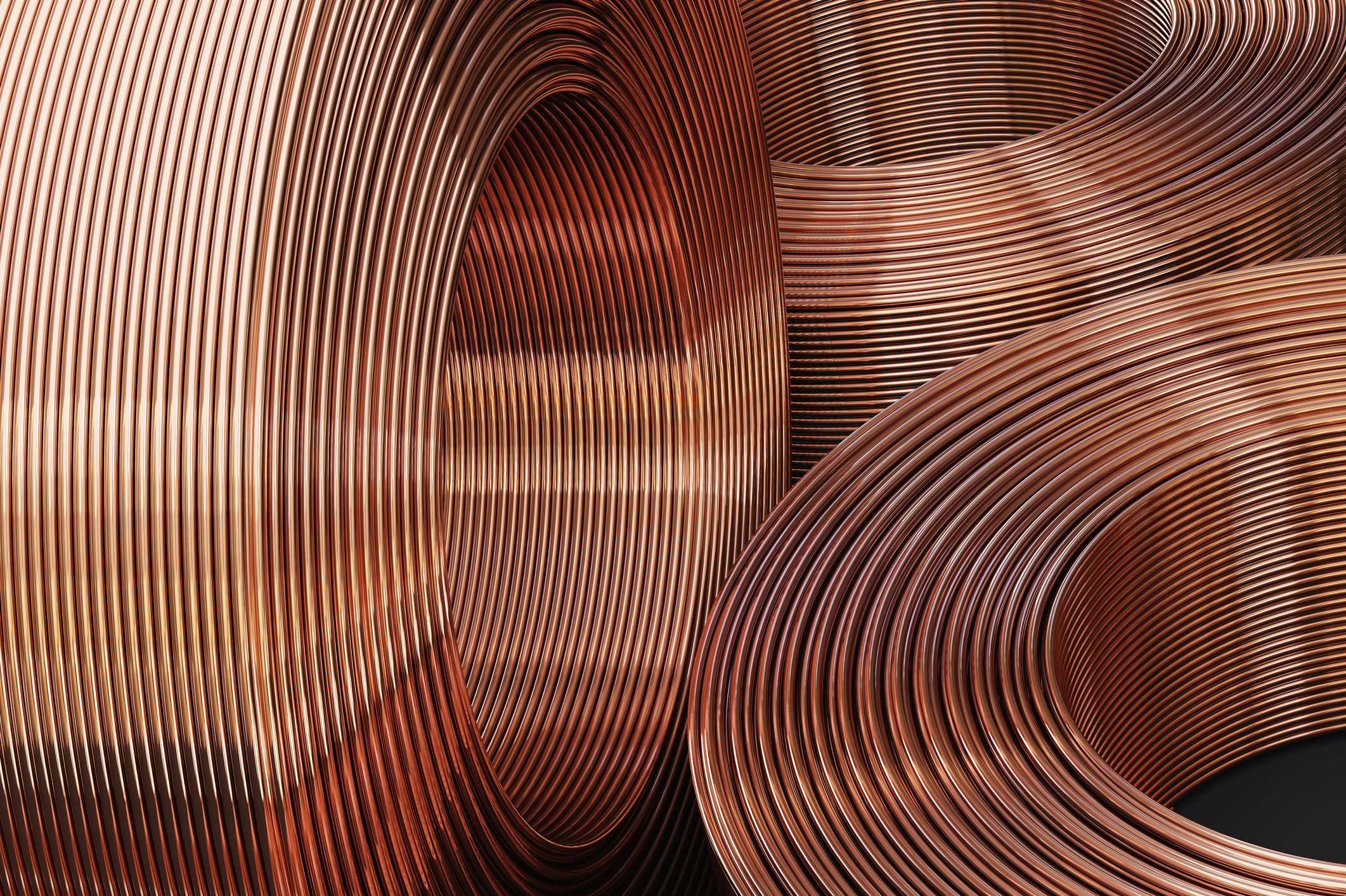

Understanding the Copper Market

The copper market is currently experiencing price fluctuations that provide investment opportunities.

Reasons to Buy Copper Stock

- Increased demand: The global demand for copper is rising due to its essential role in construction and electronics.

- Investing potential: Buying during dips can maximize your investment returns over time.

- Market positioning: This particular stock holds a strong position in the copper industry, making it a valuable addition to your portfolio.

Conclusion

In summary, the current dip in copper prices is a prime opportunity for investors. By purchasing copper stocks now, you position yourself for potential growth as market conditions improve.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.