Analyzing the Struggles of Carnival Stock Amid Business Recovery

Carnival Stock Overview

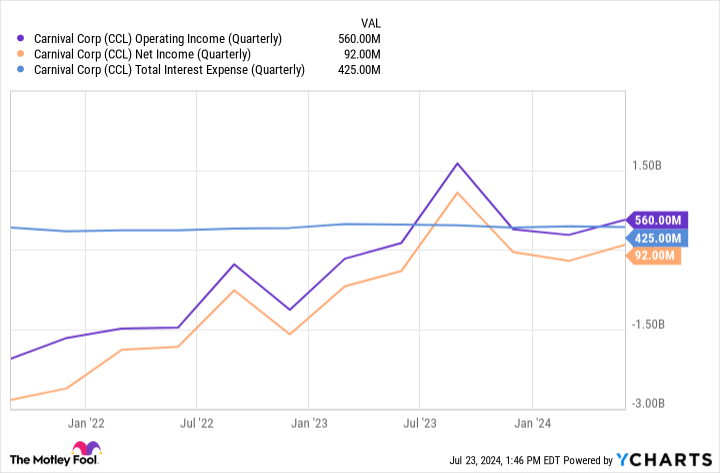

Carnival's recent performance raises eyebrows, particularly considering its 60% decline from pre-pandemic highs. Despite improvements in its business operations, the stock remains vulnerable.

Factors Behind the Decline

- Market Sentiment: Investors remain cautious about the travel industry's recovery.

- Financial Performance: Revenue growth has not translated to stock price appreciation.

- Industry Challenges: Ongoing issues such as regulatory changes and rising operational costs.

Conclusion

While Carnival's business is on the mend, its stock's substantial decline may present a buying opportunity. Investors should weigh both the risks and prospects before making their decision.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.