Debt-for-Nature Swaps: A Viable Strategy for Climate Adaptation

Introduction to Debt-for-Nature Swaps

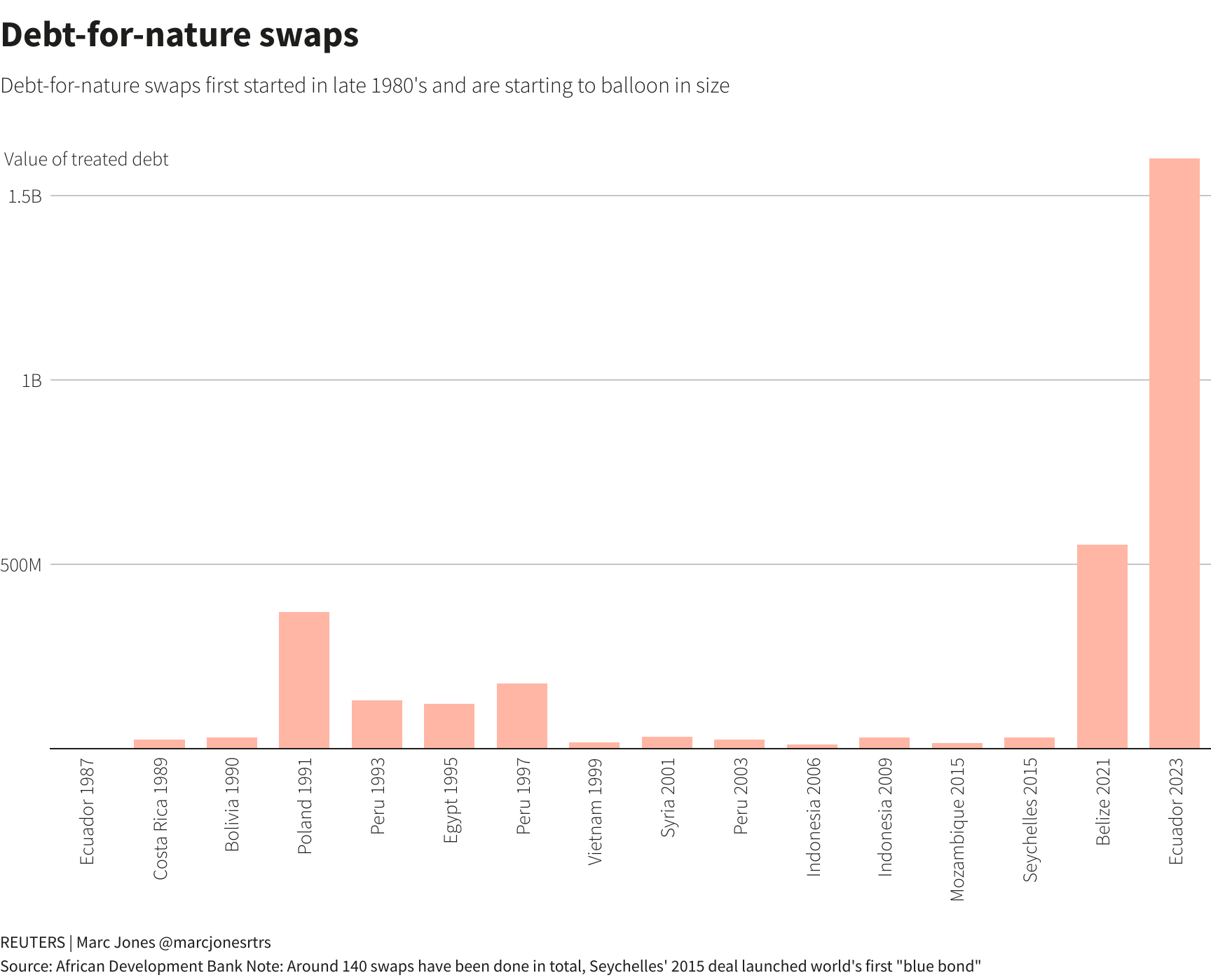

Debt-for-nature swaps are an innovative approach that allows countries to alleviate their national debt in exchange for commitments to environmental conservation.

The Financial Potential

According to recent reports, these swaps could unlock $100 billion aimed at restoring nature and adapting to climate change.

How They Work

- The country’s debt is purchased at a discount.

- In return, the debtor commits to funding conservation projects.

Benefits of Debt-for-Nature Swaps

- Economic Relief: Countries can reduce their financial burdens.

- Environmental Impact: Focus on ecological restoration helps combat climate change.

- Attracting Investment: Demonstrating commitment to sustainability can draw further investment.

Conclusion

As the need for sustainable practices grows, debt-for-nature swaps could serve as a robust mechanism to foster both economic and environmental benefits, making them crucial instruments in the fight against climate change.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.