July 2024 Economic, Housing, and Mortgage Market Outlook

U.S. Economic Growth Slows Down

The U.S. economy is facing a slowdown, with growth for Q1 2024 hitting its lowest point since Q2 2022. This decline raises significant concerns about the overall health of the financial system.

Labor Market Cooling

In conjunction with economic deceleration, the labor market shows signs of cooling. The interplay between economic growth and labor force stability is crucial for understanding consumer behavior.

Impact on Consumer Delinquencies

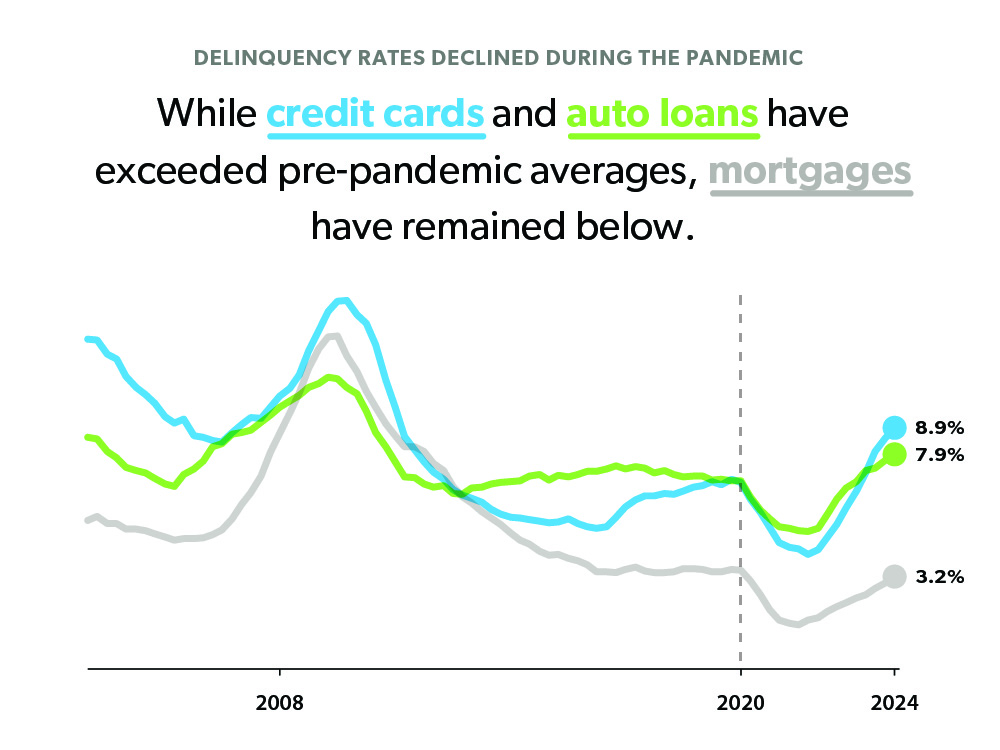

- Increased Delinquencies: As economic conditions deteriorate, consumer delinquencies are projected to rise.

- Housing Market Concerns: The housing and mortgage markets are particularly vulnerable during such economic shifts.

Conclusion

Given the current economic indicators, a cautious approach is recommended for consumers and investors alike. Continuous monitoring of these trends will be essential for making informed financial decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.