Stock Market Rotation: Why Small Stocks Are Surging While Big Tech Lags

Market Dynamics Shifting in Favor of Small Stocks

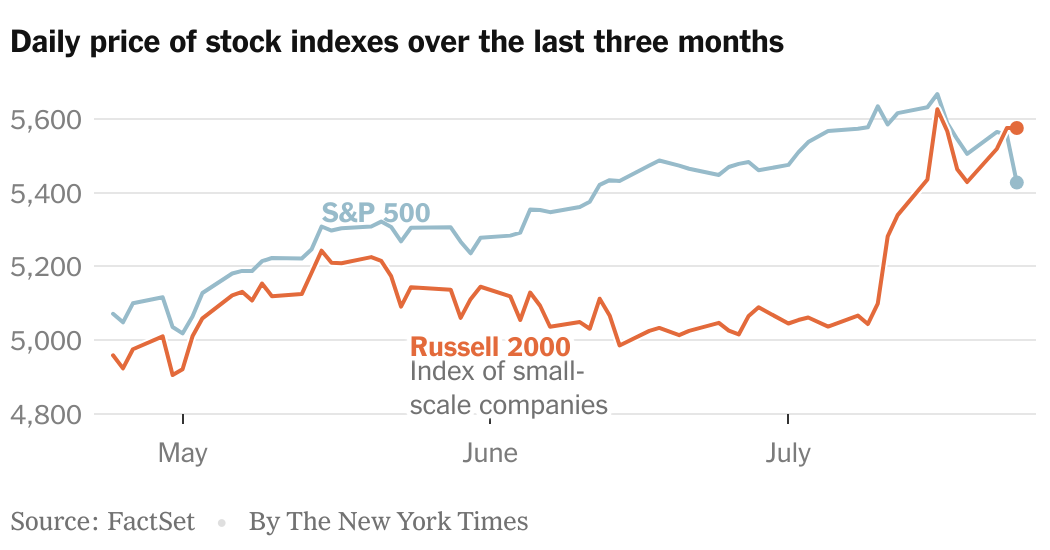

The recent shift in investor sentiment has led to a notable rotation in the stock market, spotlighting small stocks and those linked to the economic cycle.

Current Trends

- Small-cap stocks are currently outperforming large-cap tech stocks.

- Investors are turning to companies potentially benefiting from economic recovery.

- Big Tech companies are falling behind in this market rotation.

Implications for Investors

Understanding the reasons behind this transition is crucial for investors. The confidence in the economic cycle can impact asset allocation decisions and future market movements.

Conclusion

As small stocks gain traction, market participants must consider whether this trend will endure, or if big tech will reclaim its dominance as economic conditions evolve.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.