Understanding the Current Sector Rotation: Opportunities for Investors

The Current Market Shift

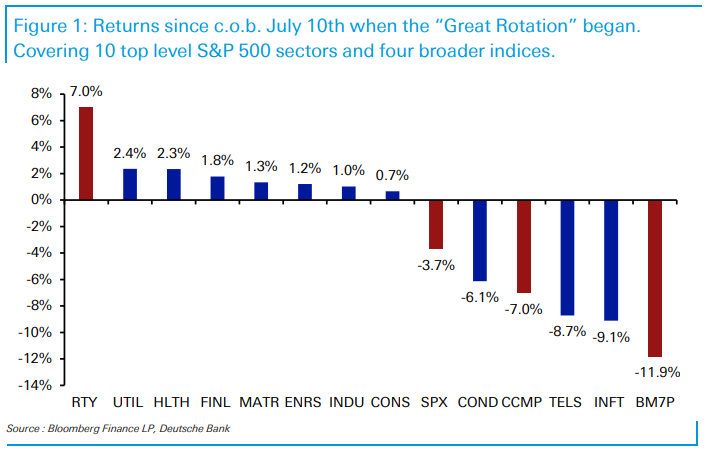

The recent rotation in the stock market highlights the need for investors to reassess their strategies. The shift suggests that focusing on nebenwert stocks can be beneficial.

Historical Context

Similar patterns were observed during the burst of the tech bubble in 2000, where opportunistic shifts led to profitable outcomes.

Investment Opportunities

- Sector Rotation allows investors to capitalize on the performances of different indices.

- Stocks from the Russell 2000 are particularly noteworthy due to their potential growth.

Conclusion

Investors who adapt to current market trends and shift focus towards next-gen stocks are likely to realize substantial profits. It is essential to stay informed and strategically align with the evolving landscape.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.