Intel Stock: Is It Time to Invest with a Low PEG Ratio?

Intel Stock Overview

Intel (INTC) has been experiencing a tough period, as it has underperformed compared to its peers in the chip-making sector.

Stock Performance

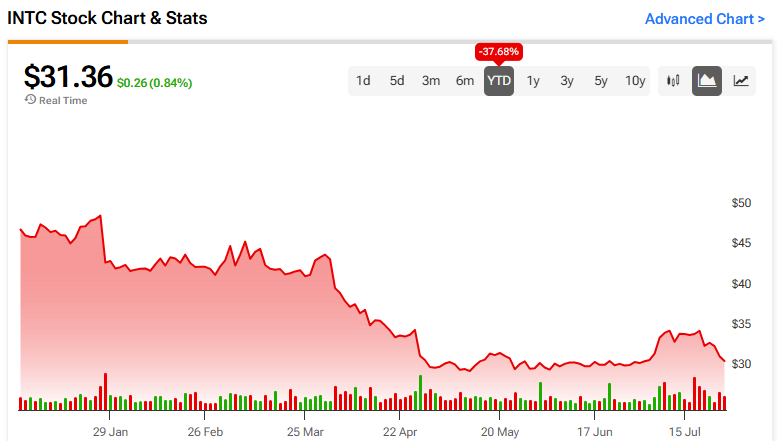

- Down 37.7% since the beginning of the year.

- Declined 32% over the last five years.

Valuation Metrics

The stock’s valuation is drawing attention due to:

- Projected growth in Client Computing Group (CCG).

- Growth potential in the Data Center and AI Group (DCAI).

- Current trading at 30.3x non-GAAP forward earnings.

- A PEG ratio of 0.6x, indicating potential undervaluation.

Conclusion

Considering Intel’s current valuation metrics, particularly its low PEG ratio, it may present a viable investment opportunity for those looking to invest in the chip-making industry.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.