Labour's Decision Affects NatWest's £5.6 Billion Stake Sale

NatWest Stake Sale: An Overview

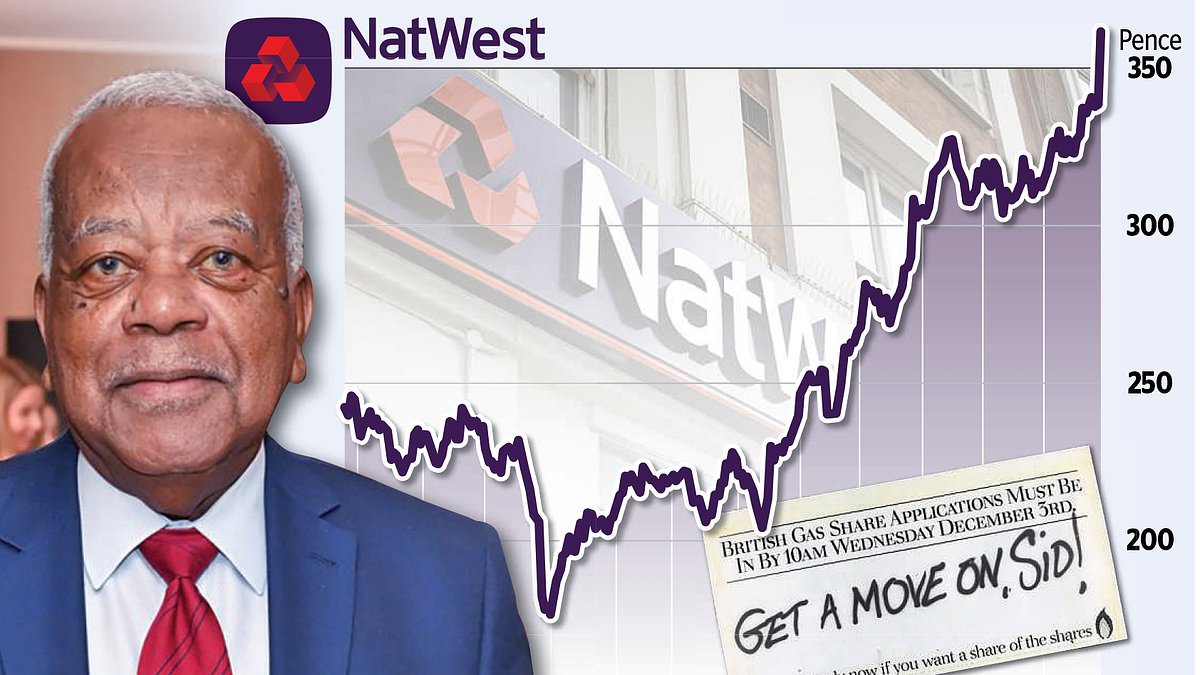

NatWest is facing challenges as the Labour party has decided to kibosh the planned 'Tell Sid' share sale.

Strategic Shift

Rachel Reeves, a key figure in Labour, intends to offer the Government's £5.6 billion stake to pension funds, insurers, and asset managers instead of ordinary investors.

Implications of the Decision

- This decision marks a shift in policy that could limit retail investment.

- The focus on institutional investors may impact market accessibility.

- The political climate is crucial in reshaping financial strategies.

In conclusion, the Labour party's stance against the 'Tell Sid' initiative may alter the landscape for NatWest's share offerings, steering them away from retail investor engagement.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.