Understanding the US Core PCE YoY Growth and Its Implications

Friday, 26 July 2024, 12:30

US Core PCE Data for June 2024

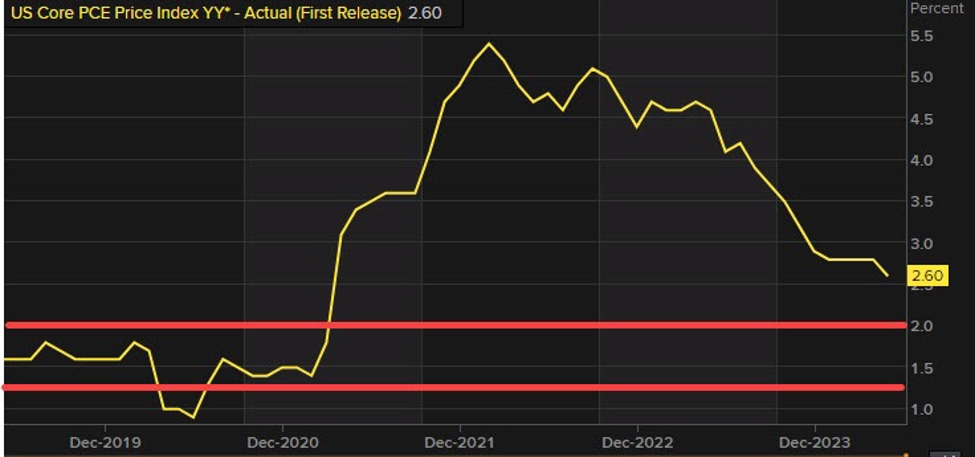

The US Core PCE index measures the prices consumers pay for goods and services, excluding the more volatile categories of food and energy.

Key Highlights

- Core PCE for June is reported at 2.6%, exceeding the forecast of 2.5%.

- This trend reflects underlying inflation pressures in the economy.

- Personal income and consumption data from the same period also indicates a stable economic environment.

Conclusion

The data suggests ongoing moderate inflation, which may have implications for future Federal Reserve policy adjustments.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.