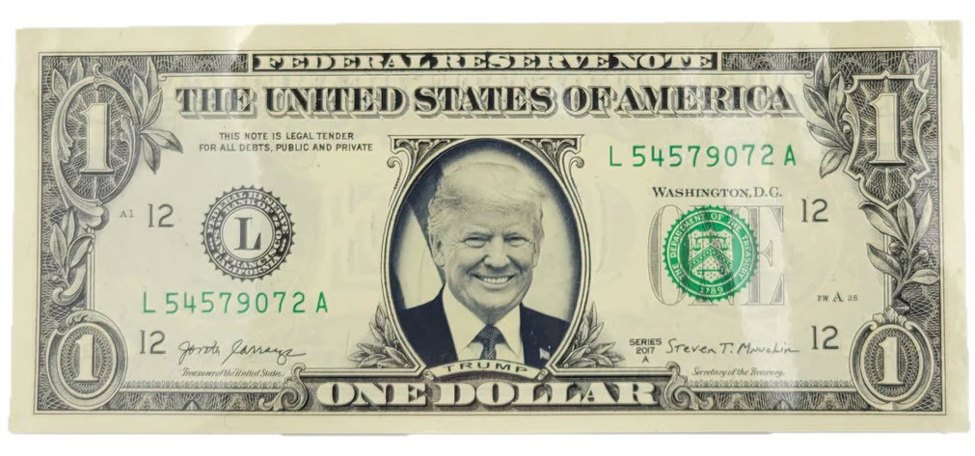

Trump's Stance on the U.S. Dollar: Implications and Possibilities

Trump's Currency Concerns

Former President Donald Trump raised alarm about the strong U.S. dollar, calling it a big currency problem. According to his remarks made to Bloomberg, he advocates for a weaker dollar, which he believes may boost U.S. exports and help the economy.

Implications of a Weaker Dollar

- Boost in Exports: A weaker dollar could make American products cheaper abroad, potentially increasing demand.

- Inflation Concerns: However, a weaker dollar might lead to higher import costs and contribute to inflation.

- Market Reactions: Financial markets could react negatively to any attempts to deliberately weaken the dollar.

In conclusion, while Trump's desires might hint at beneficial outcomes for trade, the overall consequences of a weaker dollar could have complex repercussions on the economy.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.