The Rising Costs of Lifetime Spending in an Inflationary Landscape

Friday, 26 July 2024, 06:00

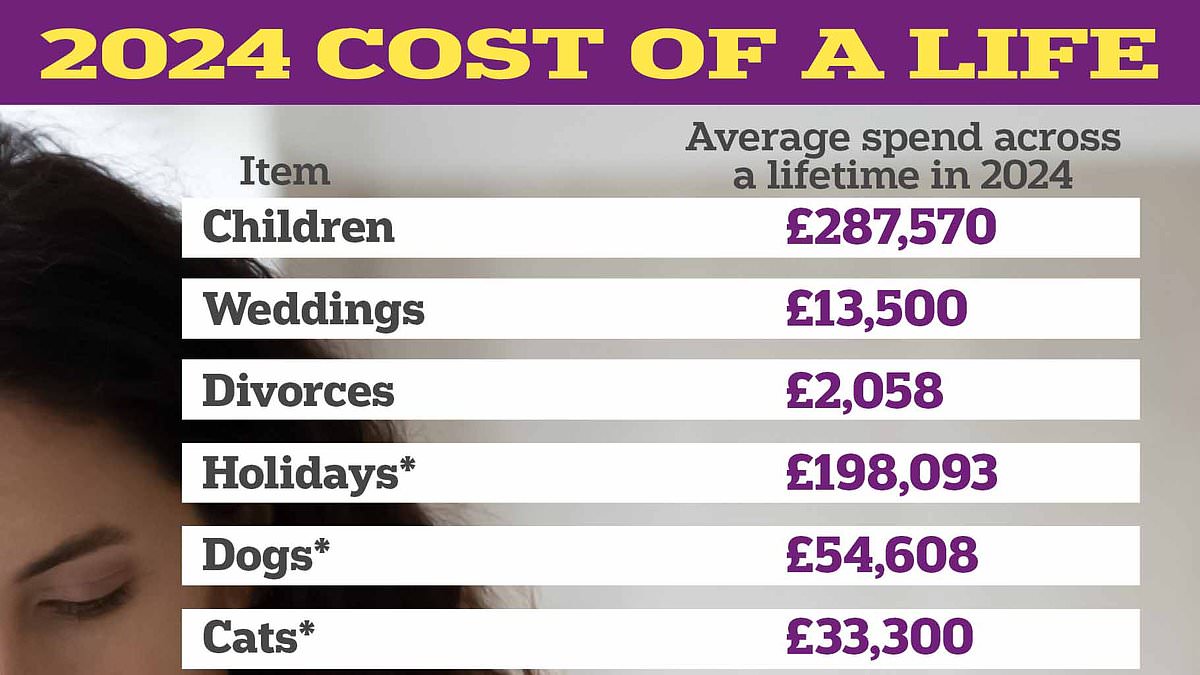

Lifetime Spending Analysis

The latest data indicates that total lifetime spending has significantly increased since 2021, primarily due to inflation. Understanding where this money goes is essential for effective financial planning.

Key Contributors

- Housing: Buying a home is one of the primary expenditures fueling this rise.

- Travel: Going on holiday has also seen substantial increases in costs.

Conclusion

As inflation persists, individuals need to reevaluate their spending habits and financial strategies to navigate these changes effectively.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.