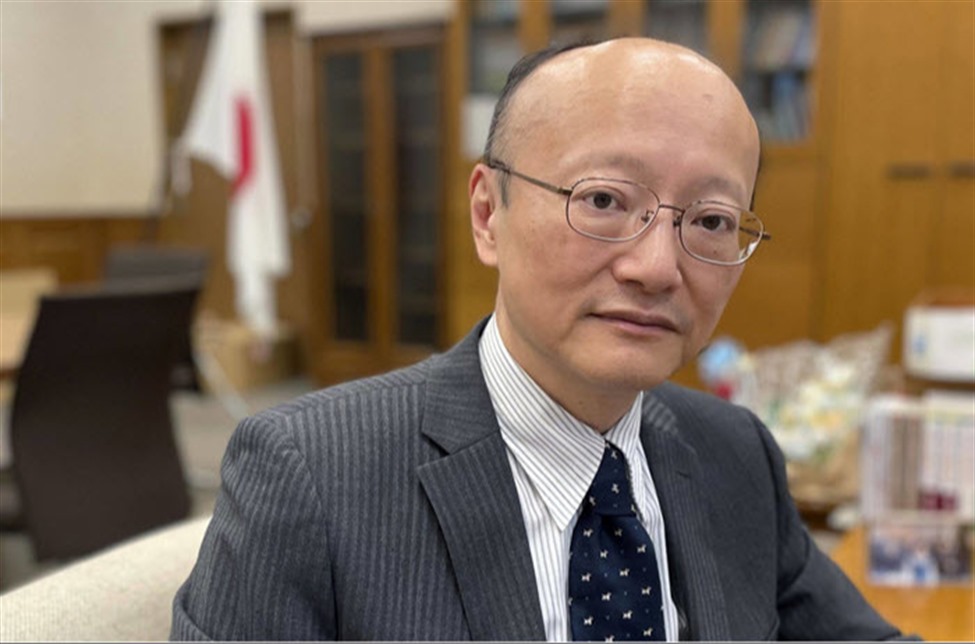

Japan's Kanda Highlights Dangers of Excessive Forex Volatility at G20 Meeting

Thursday, 25 July 2024, 23:39

Japan's Kanda and G20 Discussions

At the G20 summit, Kanda articulated the concerns regarding excessive foreign exchange volatility. He highlighted the negative consequences this volatility can have on the economy.

The Risks of Currency Fluctuations

- Economic Stability is threatened by currency market instability.

- Market Sentiment can drastically shift with rapid currency changes.

- Government Intervention remains a potential response to extreme fluctuations.

Conclusion

Kanda's remarks serve as a significant warning that forex volatility is not just a market issue but a key concern for global economic governance.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.