Goldman Sachs Forecasts Potential $7 Billion Stock Sell-Off as Market Declines

Goldman Sachs Warning on Potential Stock Sell-Off

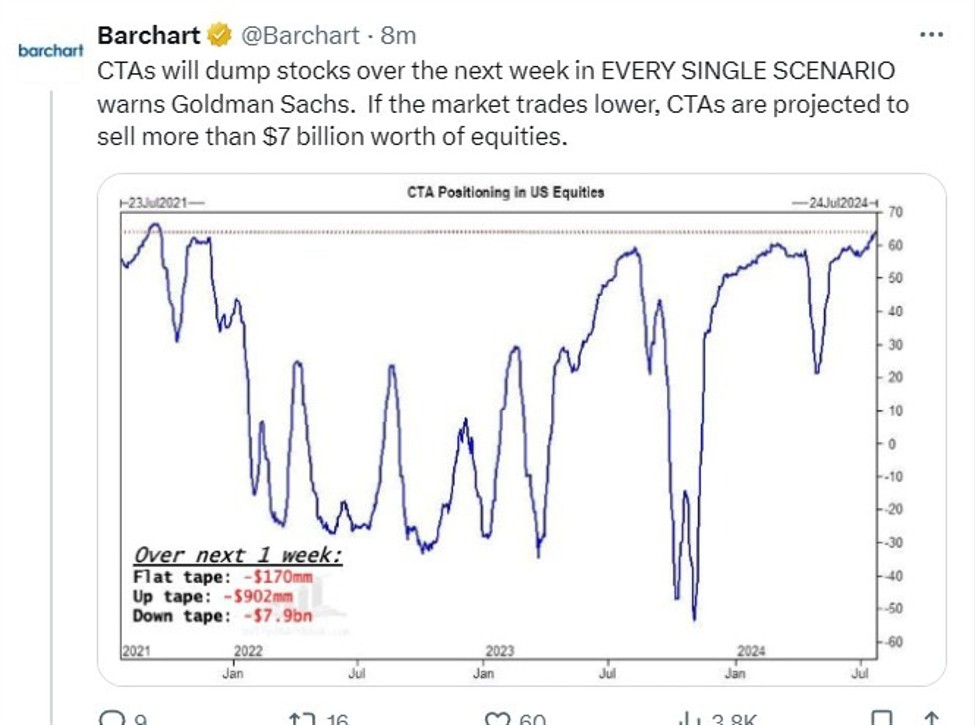

Goldman Sachs has indicated that if the current market decline persists, Commodity Trading Advisors (CTAs) may be forced to liquidate approximately $7 billion in stock assets. This scenario raises concerns for further market instability as it suggests a potential wave of selling activity.

Impact of Market Dynamics

Historically, when the market experiences significant dips, buyers often step in to purchase undervalued stocks. However, if these dip buyers do not materialize quickly, CTAs are likely to respond by dumping large amounts of stocks. This reaction could exacerbate the market's decline.

- Continued pressure on equity markets

- Possible triggering of panic selling

- Impact on investor confidence

Conclusion

The anticipated sell-off by CTAs could have serious implications for market health. Investors should stay informed and prepared for potential volatility on the horizon.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.