Understanding the Recent Drop in Short Interest for Lamb Weston Holdings (NYSE: LW)

Overview of Lamb Weston Holdings

Lamb Weston Holdings, traded under the ticker symbol NYSE: LW, has experienced a drop in its short interest. The recent data shows a fall of 7.55% in the short percent of float since the last report.

Current Short Interest Statistics

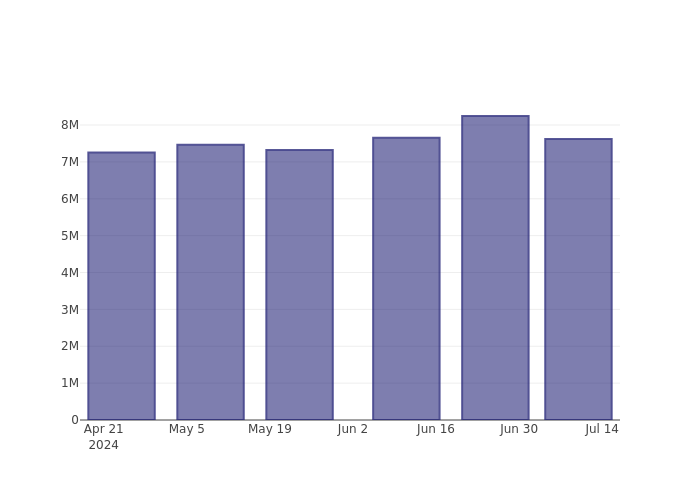

The company currently reports 7.62 million shares sold short, which accounts for 6.0% of all regular shares available for trading. This activity implies a significant change in investor sentiment.

Importance of Short Interest

Short interest is a crucial metric as it indicates the number of shares sold short but not yet covered. Investors engage in short selling with the hope that the stock price will decline, allowing them to buy back shares at a lower price. If the price rises, they face potential losses.

Conclusion

The decrease in short interest in Lamb Weston Holdings may suggest a shift in investor outlook, making it a valuable point of analysis for those looking to understand market dynamics and potential future movements.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.