Bank of Canada Lowers Key Interest Rate Again: Understanding the Implications

Bank of Canada Interest Rate Cut

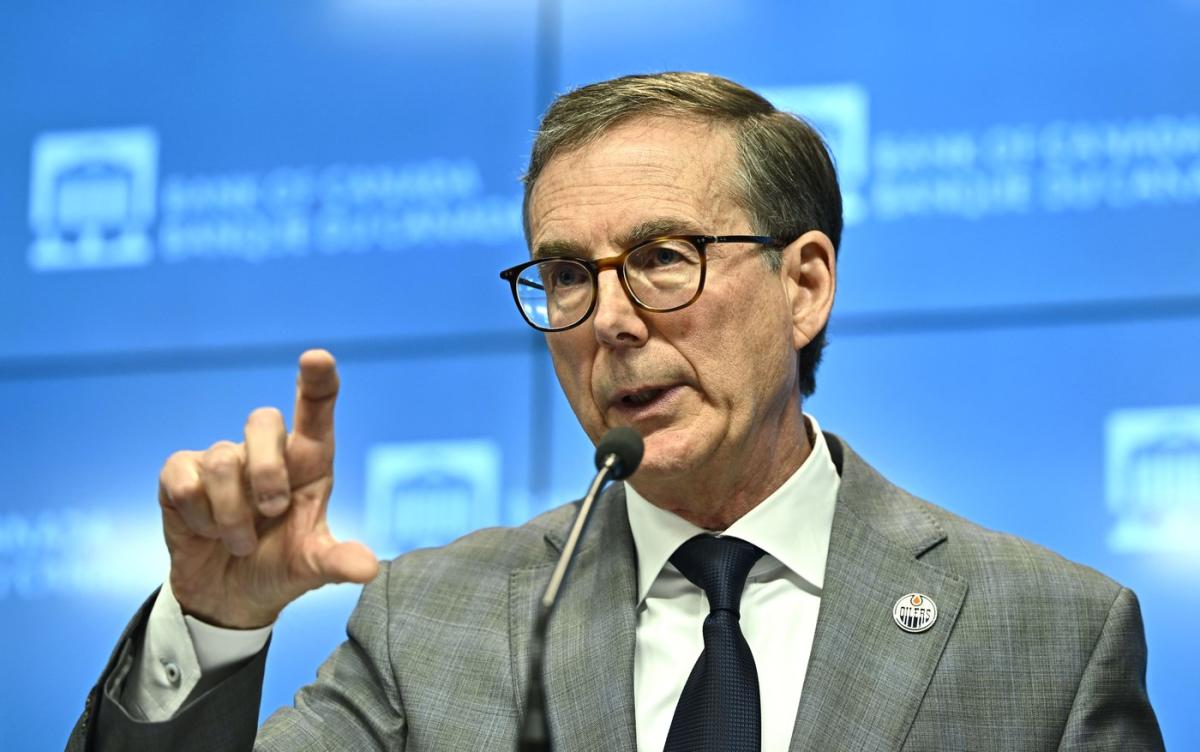

OTTAWA — On July 24, the Bank of Canada announced a reduction in its key interest rate by a quarter percentage point to 4.5%. This decision reflects the bank's ongoing efforts to manage inflation amidst economic fluctuations.

Implications of the Rate Cut

The central bank has indicated that this is the second consecutive rate cut, raising concerns about inflation trends. The governor emphasized that achieving a stable inflation rate of two percent will be a complex and uneven journey.

Future Outlook

- The pace of future rate cuts will hinge on inflation dynamics.

- Economic indicators will play a crucial role.

- Investors should remain vigilant regarding ongoing economic analyses.

In conclusion, while the recent cut aims to bolster economic activity, the path ahead remains uncertain and will require careful monitoring.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.