Understanding the Threat of Zombie Mortgages: A Growing Concern for Homeowners

The Rise of Zombie Mortgages

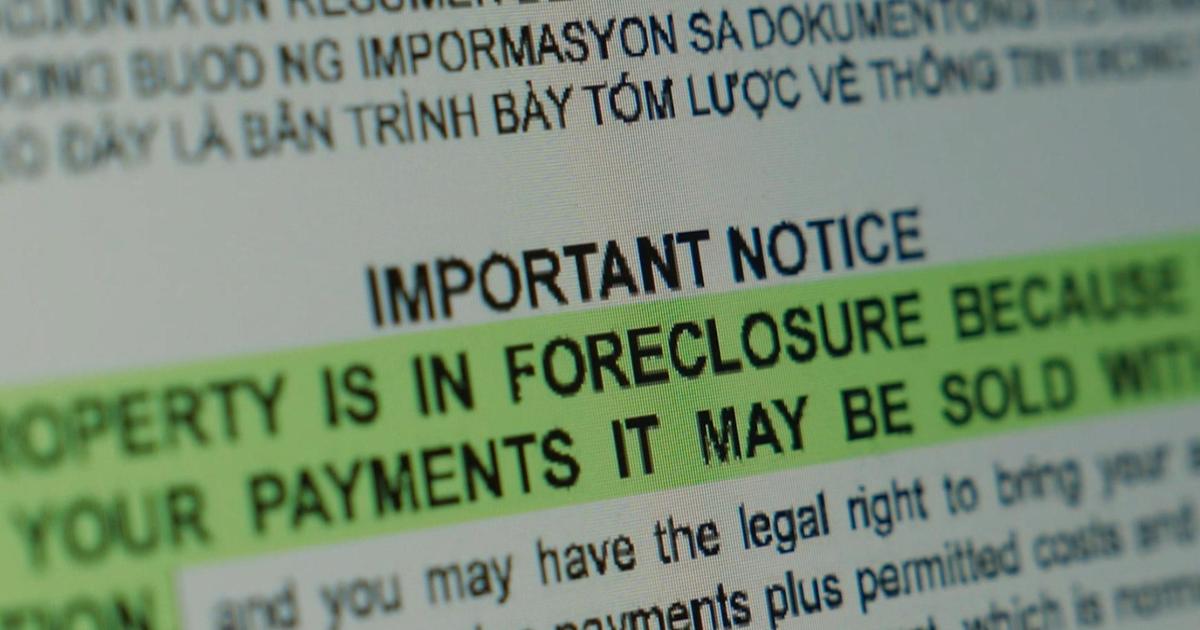

Potentially tens of thousands of homeowners are suddenly facing foreclosure risks due to "zombie" mortgages. Many of these loans, originating from the 2008 financial crisis, have left borrowers in difficult situations.

Consumer Advocate Warnings

Recent reports suggest that a new wave of zombie mortgages could emerge, linked to home equity lines of credit taken out during the pandemic.

- Homeowners are making mortgage payments on time.

- Loans could revert to a default status.

- Urgent calls for awareness from consumer advocates.

Conclusion

As this situation unfolds, it is crucial for homeowners to stay informed and proactive to mitigate the risks associated with these time-sensitive financial products.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.