Understanding the Pros and Cons of ASML Stock in Today’s Market

Tuesday, 23 July 2024, 14:00

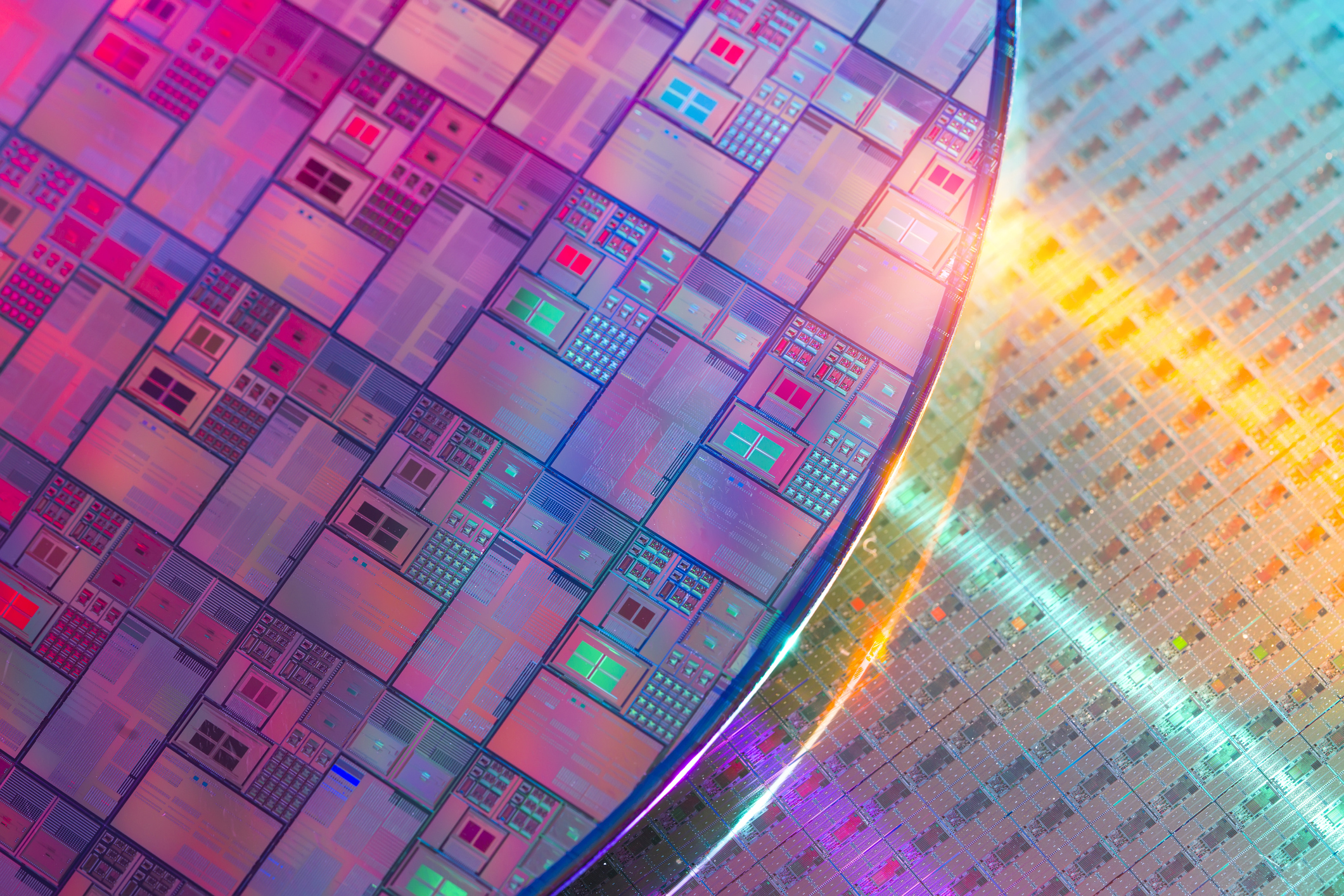

Overview of ASML Stock

The Dutch semiconductor equipment maker, ASML, is encountering a myriad of near-term challenges.

Bear Perspective

- Supply Chain Issues: The company is dealing with disruptions in its supply chain.

- Market Demand Fluctuations: There are concerns about decreasing demand for semiconductor equipment.

Bull Perspective

- Innovation Leadership: ASML remains a leader in cutting-edge technology.

- Long-term Growth Potential: Analysts believe the long-term outlook remains positive despite current challenges.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.