AUD/USD Daily Report: Analyzing the Ongoing Bearish Trends

AUD/USD Daily Report: Analyzing the Ongoing Bearish Trends

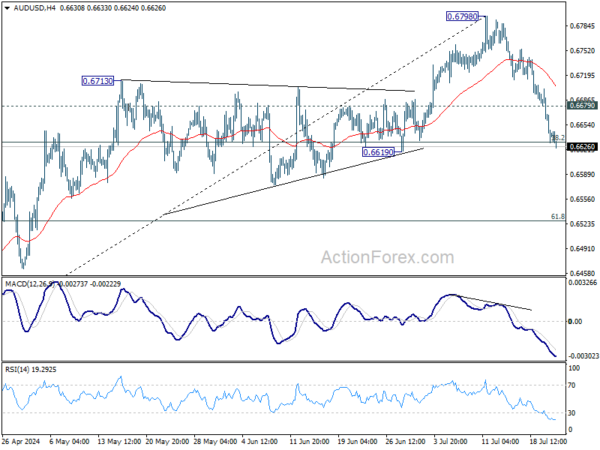

The AUD/USD currency pair is currently witnessing an accelerating decline as it continues to move lower since the peak at 0.6798.

Current Market Conditions

- Trading below the 38.2% retracement level of 0.6361 to 0.6798 at 0.6631 increases the likelihood of a near-term bearish reversal.

- The next significant target for the downward movement is the 61.8% retracement level at 0.6528.

Upside Potential

On the other hand, should the price breach the minor resistance at 0.6679, it will neutralize the intraday bias.

- Monitor the resistance at minor level of 0.6679.

- Watch for changes in the retracement levels for potential reversals.

In conclusion, the AUD/USD is poised at a critical juncture, where its movements around these retracement levels will determine the short-term trading strategy.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.