SEC's Anticipated Approval of Spot-Ether ETFs Marks a Milestone in Cryptocurrency Investments

SEC's Approval of Spot-Ether ETFs

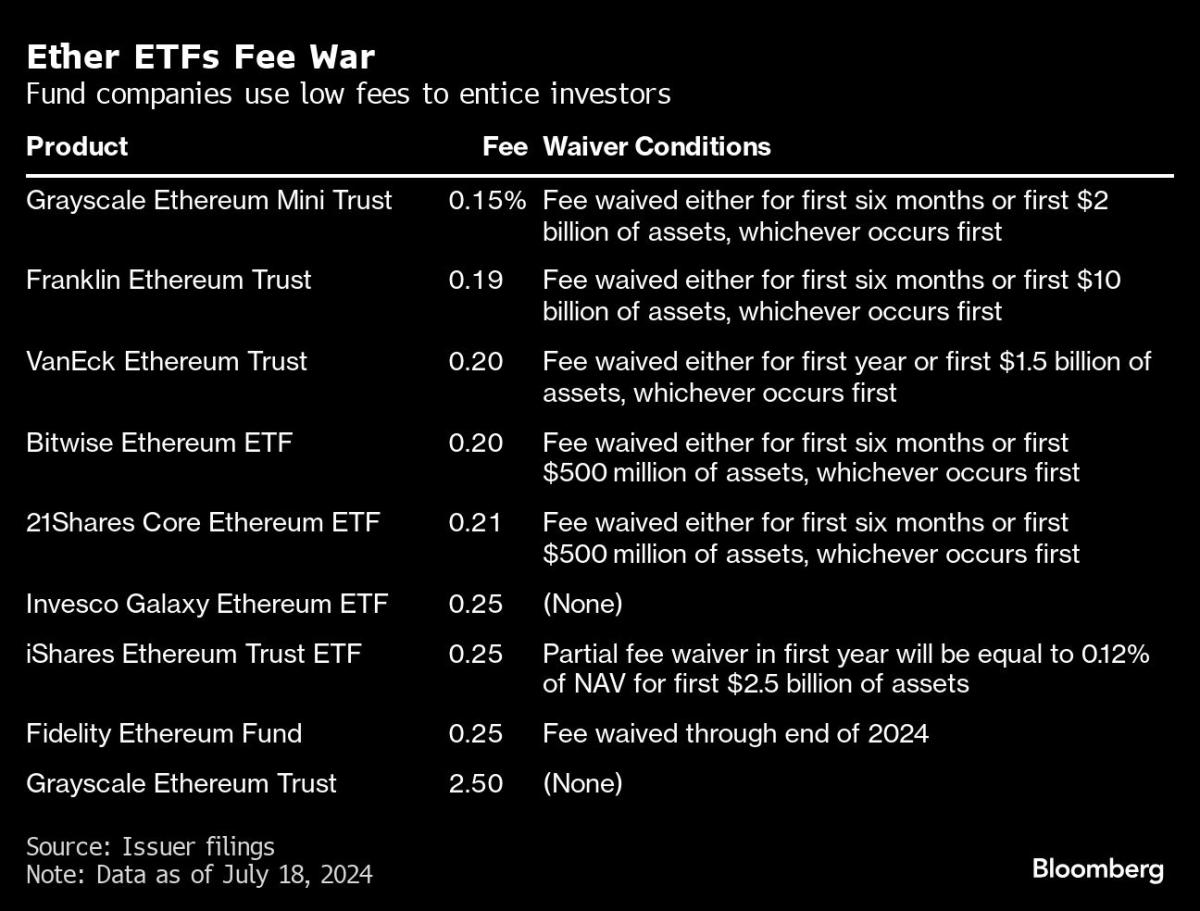

According to recent filings and announcements from asset managers, the U.S. Securities and Exchange Commission (SEC) is on the verge of approving the first exchange-traded funds (ETFs) that invest directly in Ether. This decision could transform the investment landscape for cryptocurrency, particularly for Ethereum, which ranks as the second-largest digital currency.

Significance of the Approval

- This would mark a crucial milestone in the acceptance of digital currencies.

- The approval is expected to enhance liquidity and trading opportunities for investors.

- This development could lead to increased trust in cryptocurrency markets.

- Approval of spot-Ether ETFs will likely attract institutional investors.

- This could lead to broader acceptance of Ethereum as a mainstream asset.

- The market for digital currencies may see significant growth as a result.

In conclusion, as the SEC moves towards approving spot-Ether ETFs, it signals a new chapter for cryptocurrency investments, highlighting growing confidence in digital assets within mainstream finance.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.