The Strategic Importance of Holding Intel Stock for Chip Investors

Sunday, 21 July 2024, 08:30

Understanding the Role of Intel in Chip Investments

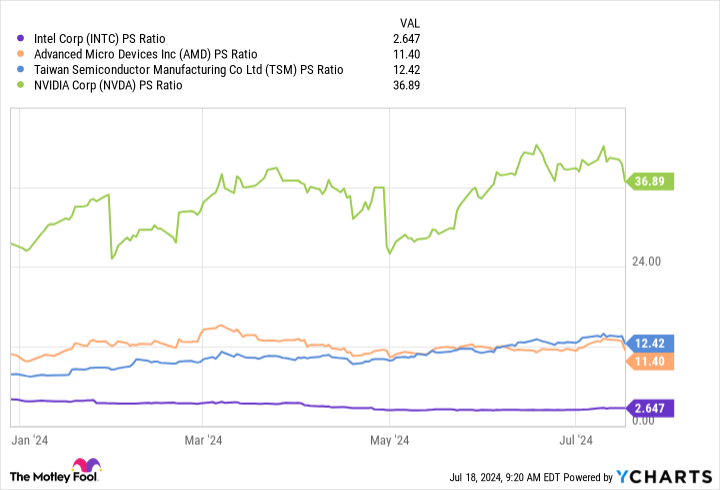

Investors should consider Intel stock as a strategic hedge in their portfolios due to its potential as a value stock. Here are some key reasons to maintain a position in Intel:

- Market Position: Intel continues to be a leader in the semiconductor industry.

- Long-term Opportunities: Despite market volatility, Intel presents significant long-term growth potential.

- Value Proposition: The stock has appealing fundamentals that can attract value-focused investors.

Conclusion

Given these factors, holding Intel stock can prove beneficial for chip stock investors looking to stabilize their investments against market uncertainties.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.