Top Solutions for Texas Residents Facing Credit Card Debt

Monday, 22 July 2024, 20:01

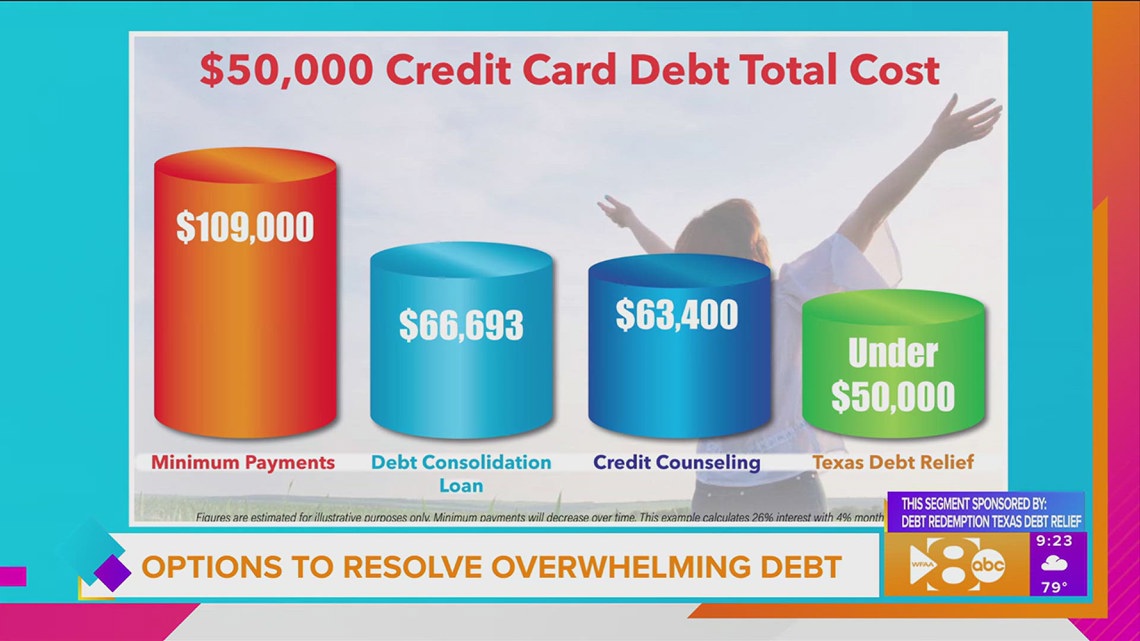

Overview of Credit Card Debt Solutions

More and more Texas residents are facing the challenges associated with credit card debt. It’s essential to understand the available strategies to manage this financial burden.

Key Options for Management

- Debt Consolidation: Combining multiple debts into a single loan with a lower interest rate.

- Negotiating with Creditors: Engaging directly to potentially lower interest rates or settle for less than owed.

- Credit Counseling: Seeking help from professionals who can guide borrowers through the repayment process.

Conclusion

Utilizing these solutions can significantly reduce financial stress and lead to improved liquidity for Texas residents dealing with credit card debt.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.