China's Central Bank Lowers Key Policy Lending Rates to Stimulate Economy

Monday, 22 July 2024, 07:49

Overview of the Interest Rate Cuts

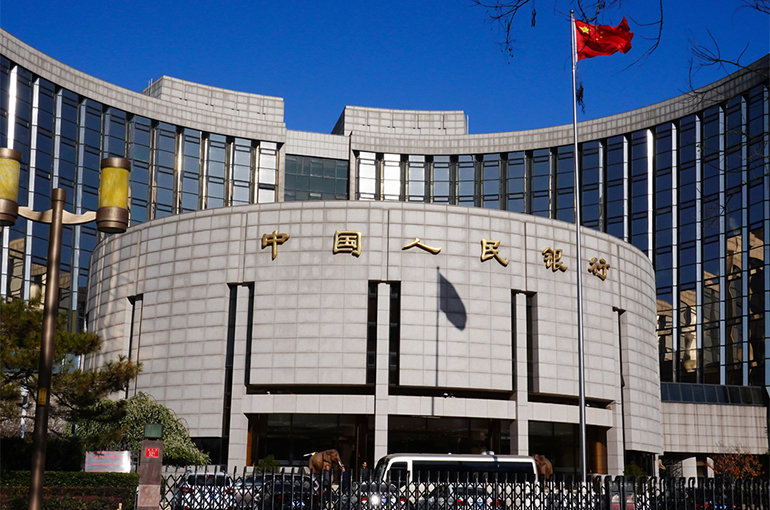

The People's Bank of China has announced significant cuts to its key policy lending rates, a decision that reflects its commitment to support the nation's economy.

Impact on the Chinese Economy

- The rate cuts are expected to increase borrowing among individuals and businesses.

- This move aims to spur consumer spending and stimulate economic activity.

- Moreover, it may enhance liquidity in the financial system.

Conclusion

By reducing the interest rates, the central bank hopes to tackle economic challenges and promote stability in the financial markets.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.