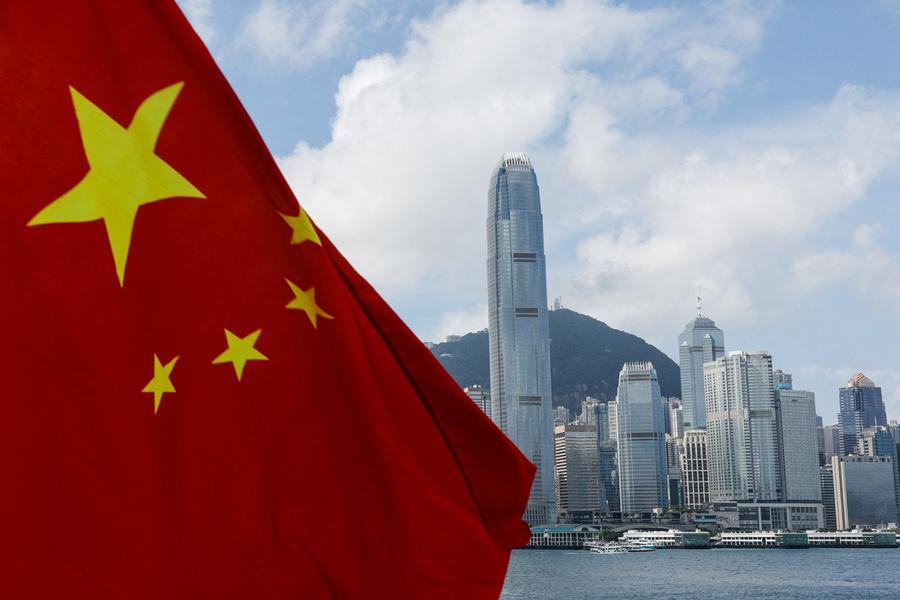

China Reduces Key Interest Rates Amid Economic Challenges

China's Benchmark Interest Rate Adjustment

The People's Bank of China has announced a reduction in its benchmark interest rates as part of its monetary policy strategy aimed at supporting economic growth. This decision comes in the wake of economic challenges faced by the country, prompting a closer look at the central bank's actions.

Key Changes in Interest Rates

- Benchmark Rate: The central bank lowered the main interest rate, impacting loans and credit availability.

- Five-Year Loan Prime Rate: A significant cut was made to the five-year loan prime rate, which is critical for setting mortgage prices.

Implications for the Economy

This adjustment in interest rates is expected to stimulate consumer spending and investment, facilitating economic recovery. As the global market experiences fluctuations, the People's Bank of China's proactive approach signifies its commitment to maintaining economic stability.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.