Investors Turn to Hedging as Market Volatility Rises

Investors Reassess Risk Management

Hedging is witnessing a resurgence as market participants confront increasing uncertainties. Concerns surrounding the US presidential election, second-quarter earnings, and the trajectory of economic growth and interest rates are prompting this shift.

Current Market Concerns

- US Presidential Election: The political landscape is becoming a significant factor for investors.

- Second-Quarter Earnings: Expectations are running high, creating potential volatility.

- Economic Growth: Fluctuations in growth rates are causing unease among investors.

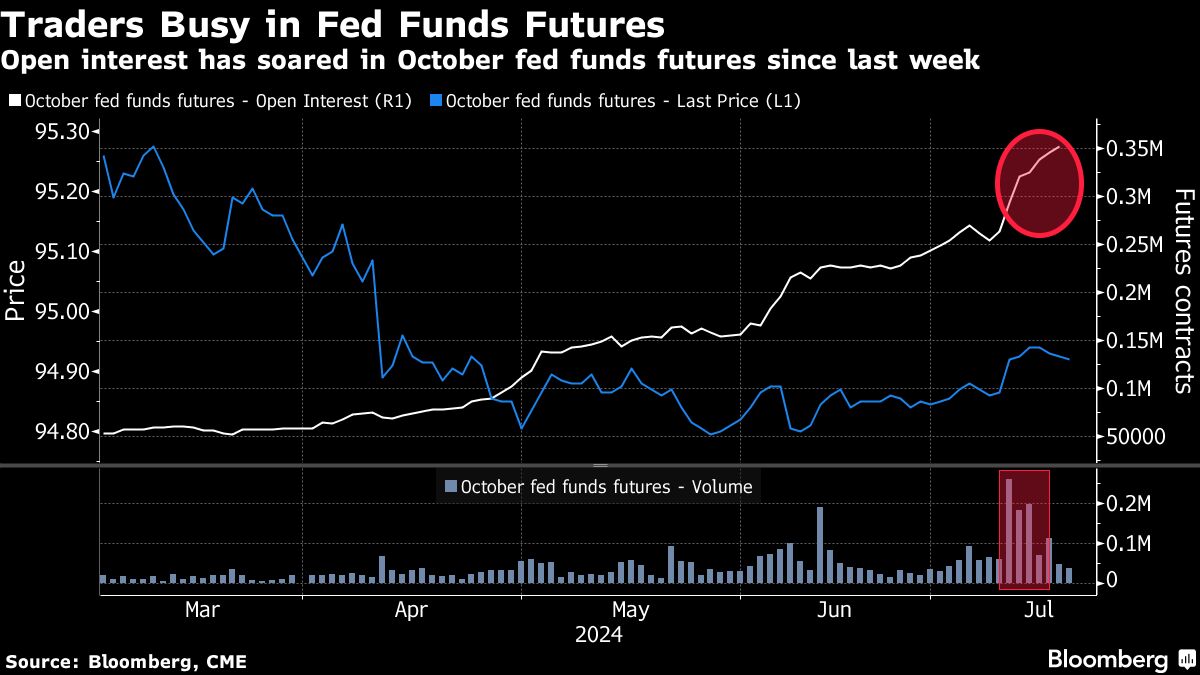

- Interest Rates: Changes in interest rates are impacting market trust.

As these factors weigh heavily, the realization that stocks can decline reinforces the importance of incorporating hedging strategies into investment approaches.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.