Analyzing the Rise in Credit Card Charge-Offs and its Implications for JPMorgan Chase

Overview of Charge-Off Rates

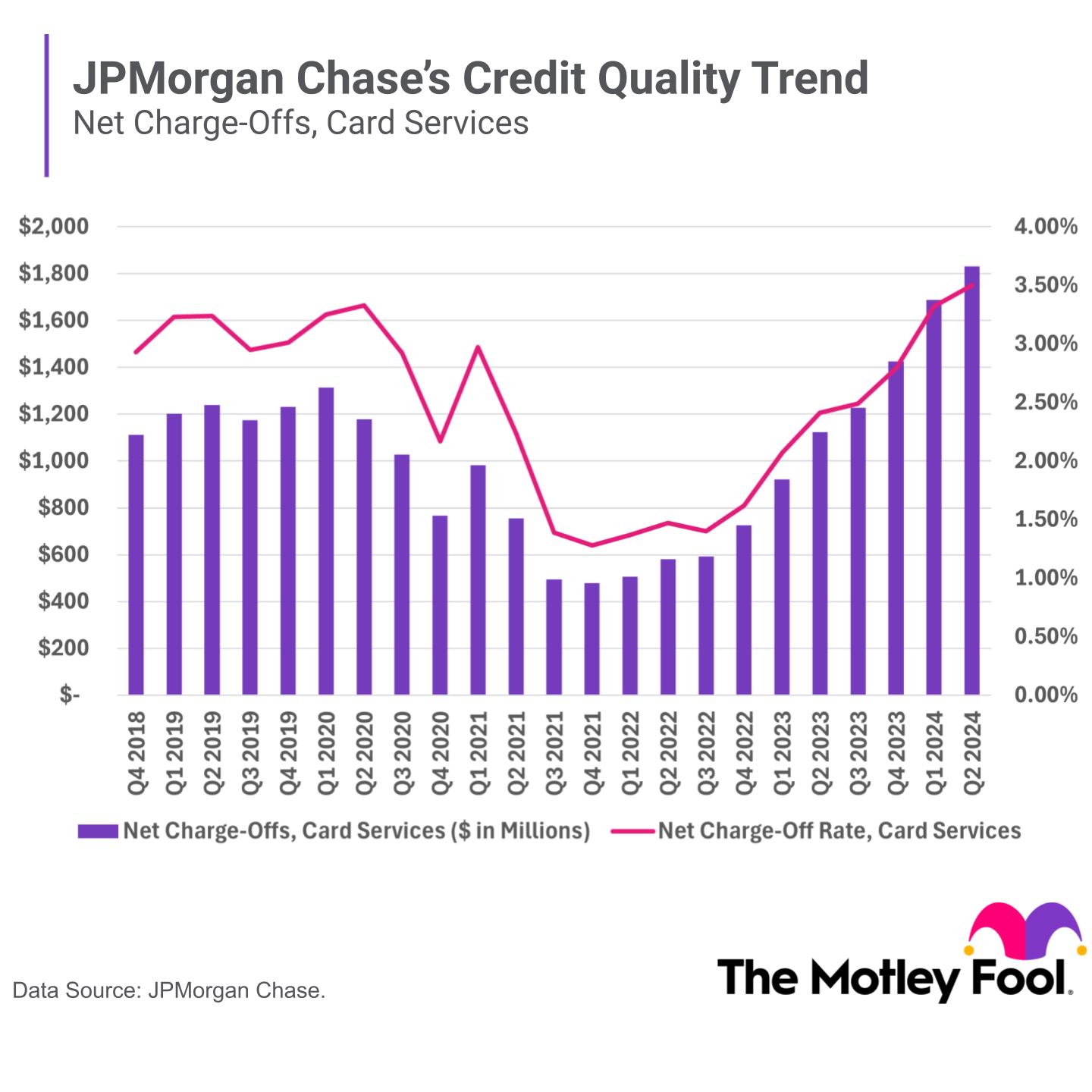

The bank's net charge-off rate on credit cards rose in the second quarter, indicating that borrowers are increasingly struggling to keep up with their financial obligations. This trend is particularly concerning as it could signal wider economic issues.

Implications for JPMorgan Chase

- Increased debt burdens among consumers may lead to higher charge-off rates.

- The bank's ability to manage its credit risk will be tested as more individuals default.

- Understanding charge-off trends is crucial for predicting potential economic downturns.

Conclusion

As JPMorgan Chase navigates this challenging environment, stakeholders should closely monitor these trends to gauge the bank's resilience and adaptability in the face of economic uncertainty.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.