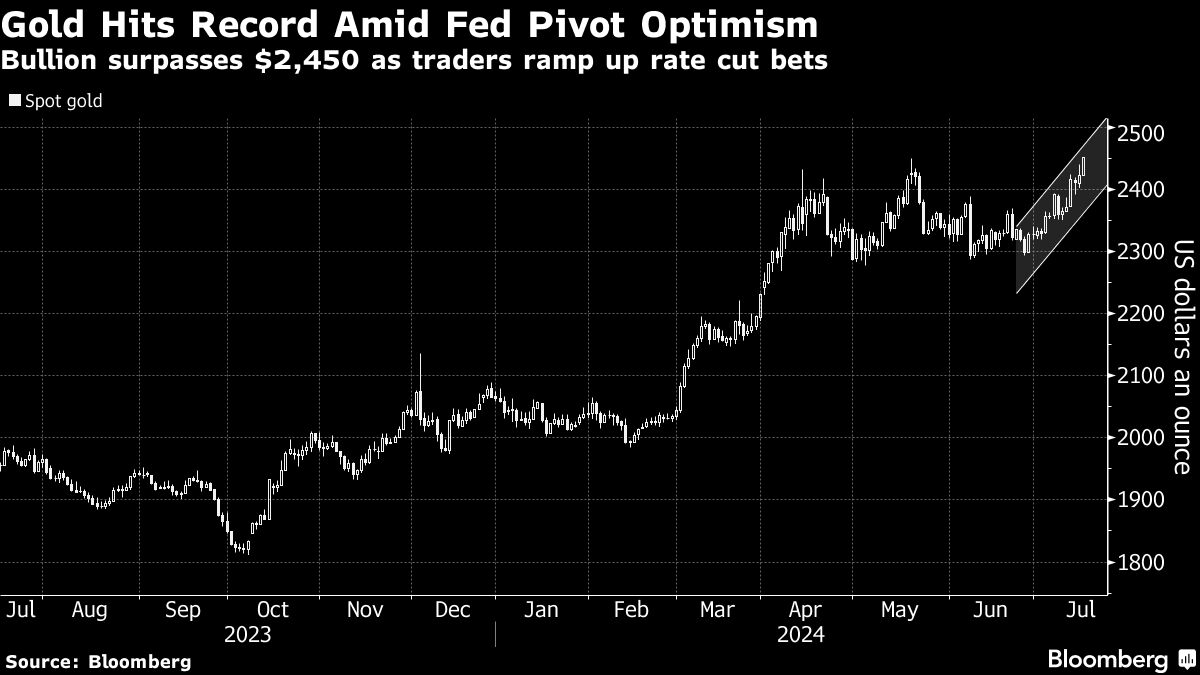

Gold Surges to All-Time High on Speculation of Fed Policy Shift

Tuesday, 16 July 2024, 20:33

Gold Prices Reach Historic Levels

Gold has achieved an all-time high due to growing speculations of Federal Reserve rate cuts.

Traders Boost Bets on Policy Changes

Market participants are intensifying their bets on potential shifts in the Fed's interest rate policies.

- Increased Opportunity: Traders are capitalizing on the perceived change in Fed strategies.

- Risk Management: The market is adapting to the evolving scenario with updated risk management strategies.

In conclusion, the rise in gold prices reflects the evolving sentiments towards Fed policy adjustments.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.