Signs of Bearish Momentum in GBP JPY Pair Point Towards Potential Reversal

GBP/JPY Weekly Outlook

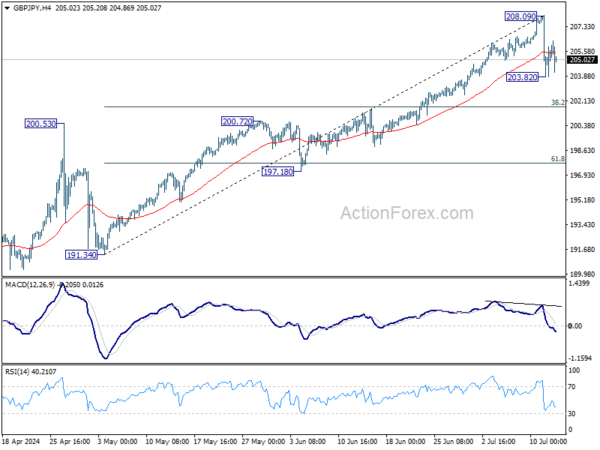

GBP/JPY retreated sharply after edging higher to 208.09 last week. Considering bearish divergence condition in 4H MACD, a short term top should be in place. Deeper pullback could be seen through 203.82 temporary low. But downside should be contained by 38.2% retracement of 191.34 to 208.09 at 201.69 to bring rebound, and set the range of consolidations. However, sustained break of 201.69 will argue that larger correction is already underway.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.