Citi Takes Action to Close Dormant Credit Card Accounts Due to Rising Payment Defaults

Friday, 12 July 2024, 16:39

Citi's Response to Financial Challenges

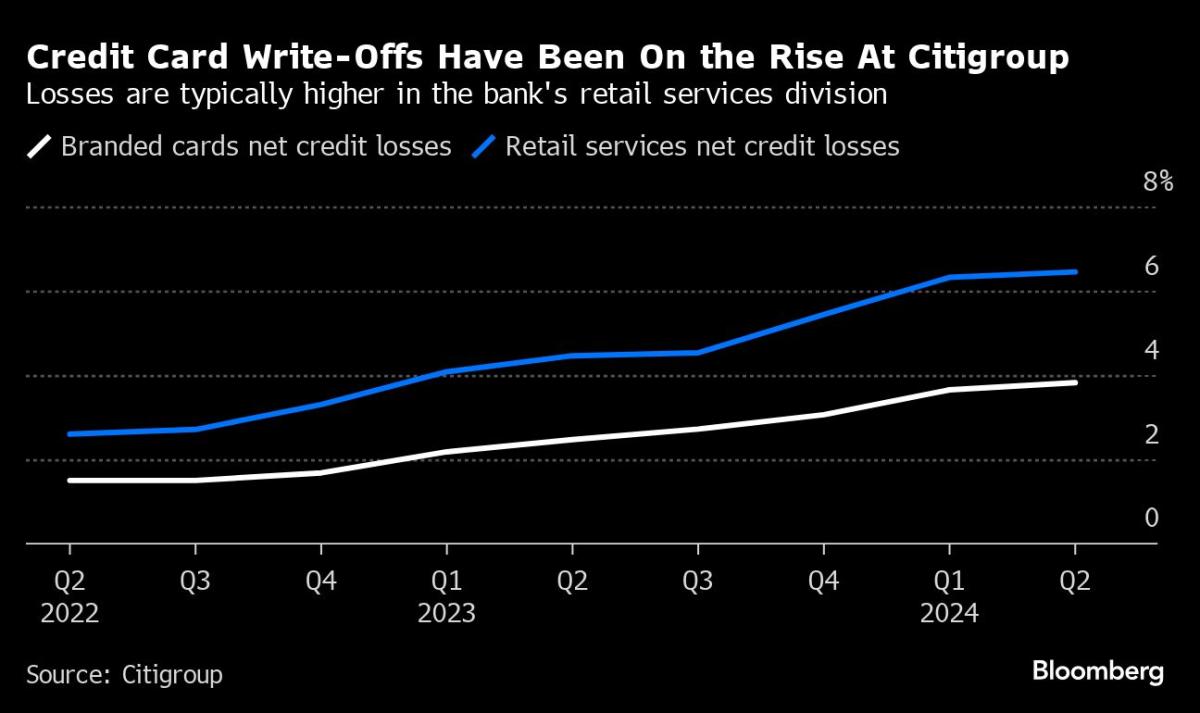

Citigroup Inc. is taking steps to address the increasing number of customers defaulting on payments by closing dormant credit card accounts.

Strategic Decision-Making

- Proactive Closures: Citi is shutting down unused accounts to mitigate losses.

- Risk Management Focus: The bank is intensifying efforts to manage escalating financial risks effectively.

In light of current market conditions, Citi's actions reflect a strategic approach to safeguard against mounting payment defaults and financial uncertainties.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.