Bank of America Strategists Forecast Increased Traders' Attraction Towards Riskier Stocks in Anticipation of Federal Reserve Interest-Rate Cuts

Friday, 12 July 2024, 16:45

Bank of America's Market Analysis

The article discusses the insights provided by Bank of America strategists on the potential consequences of the Federal Reserve's interest-rate cut expectations on investor behavior.

Key Points:

- Anticipated Rate Cut: Speculation on an upcoming rate cut by the Fed in September.

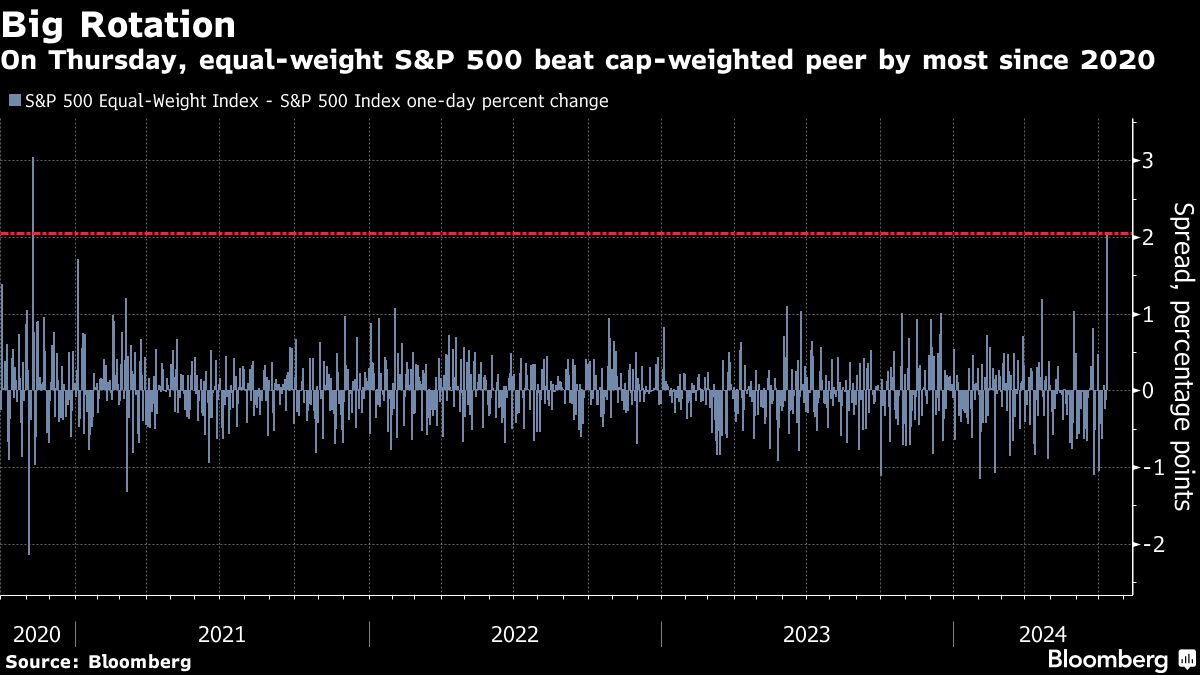

- Market Trends: Shift towards riskier assets in response to economic data.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.