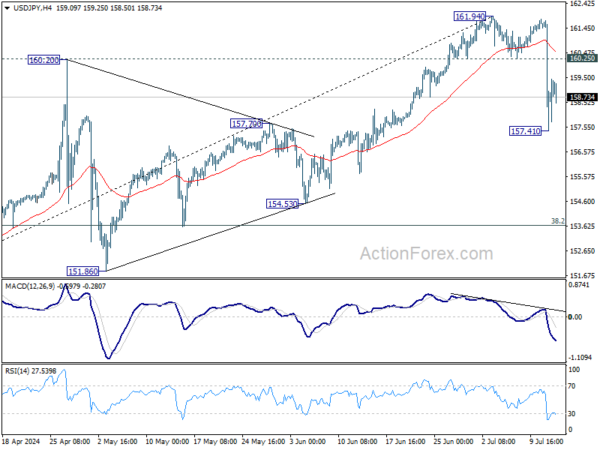

Analyzing the USD/JPY Exchange Rate: Expecting Further Decline with Key Resistance Level Holding

Friday, 12 July 2024, 13:01

USD JPY Exchange Rate Analysis

Potential Bearish Scenario Ahead

No change in USD/JPY's outlook. Deeper decline is expected with 160.25 support turned resistance intact. Fall from 161.94 is seen as corrective the five-wave rally from 140.25. Sustained break of 55 D EMA (now at 157.71) will affirm this bearish case. Next target will be 38.2% retracement of 140.25 to 161.94 at 163.65.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.