Market Reacts to US CPI Report with Expectations of Another Rate Cut

Market Sentiment Impact

The recent US CPI report has sparked shifts in investor sentiment, with many anticipating another rate cut.

Expectations for November

Investors are now pricing in the likelihood of further easing measures by the Federal Reserve in November.

Consequential Market Reactions

- Investor anticipation: Market participants are adjusting their strategies based on expectations of future rate cuts.

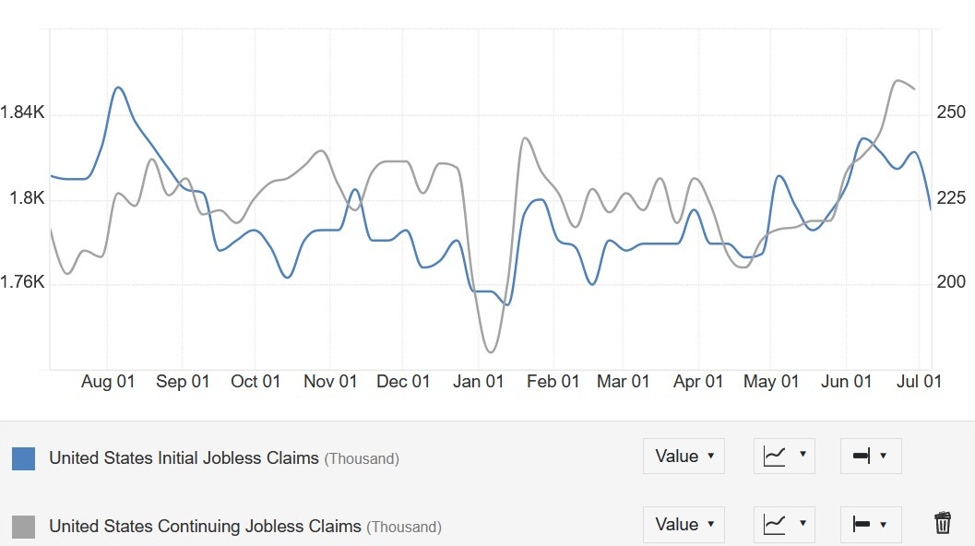

- Volatility increase: The report has introduced uncertainty, leading to fluctuations in market volatility.

In conclusion, the US CPI report has triggered changes in market sentiment and expectations, with investors preparing for potential rate adjustments in the near future.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.