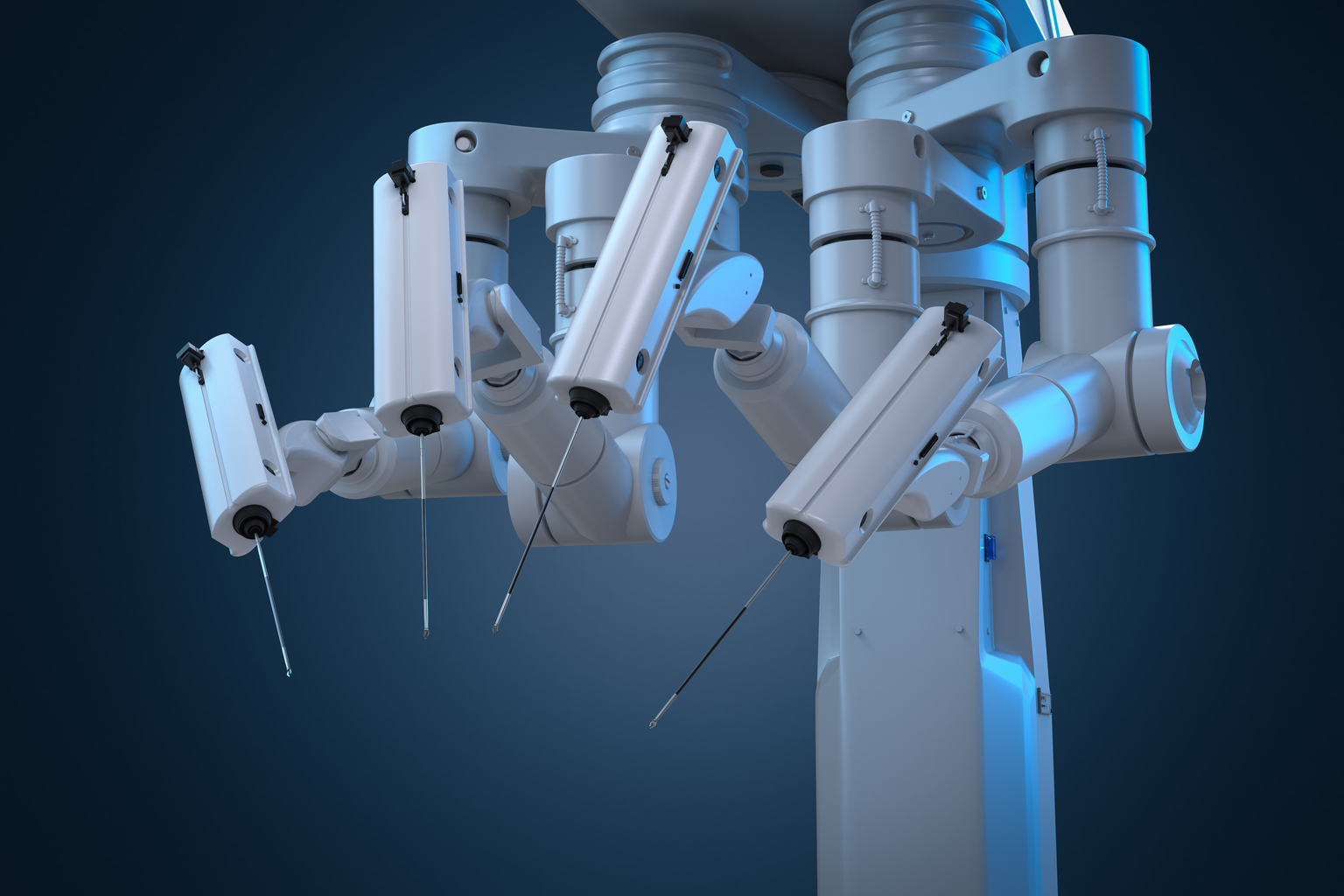

Assessing the Surge in Intuitive Surgical Stock Price and Implications of Rating Downgrade

Friday, 12 July 2024, 03:59

Intuitive Surgical Stock Analysis

Intuitive Surgical stock price is on the rise, surpassing industry benchmarks.

Highlights

- Strong Earnings Growth: ISRG stock demonstrating robust financial performance.

- Valuation Concerns: Investors cautious due to potential overvaluation.

Despite the surge, concerns over the stock’s fair value persist.

Conclusion

Investors should carefully evaluate the implications of the rating downgrade.Understanding the balance between growth potential and risk is crucial for making informed investment decisions.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.