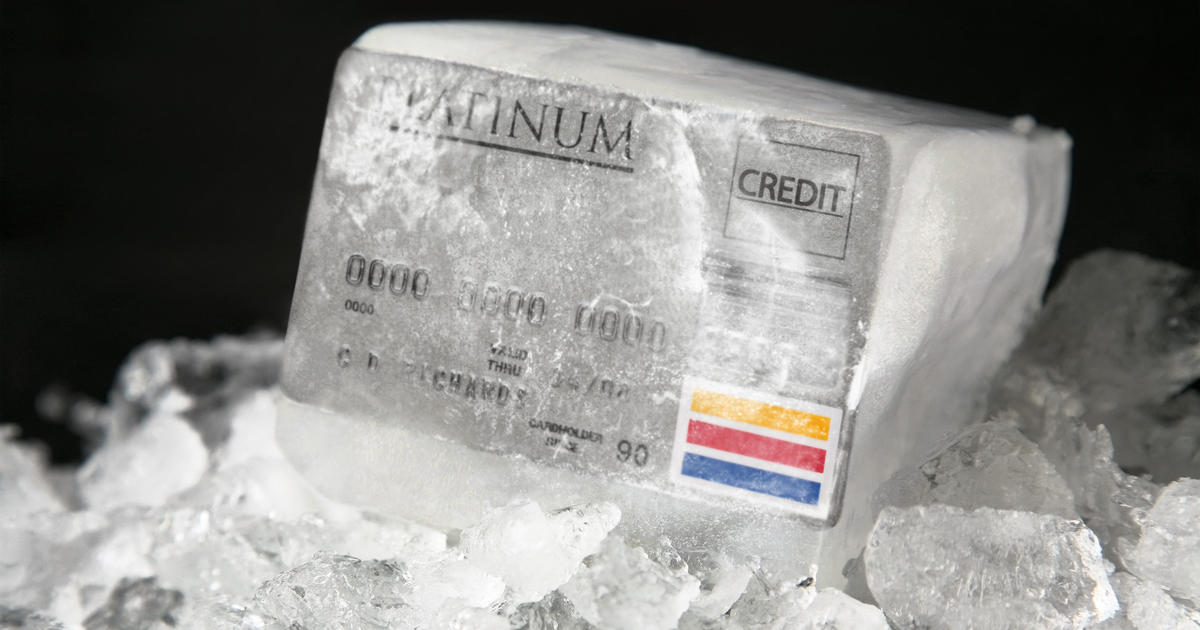

Impact of Cooling Inflation on Credit Card Debt Costs

Thursday, 11 July 2024, 20:26

Effect of Inflation on Credit Card Debt

The potential impact of cooling inflation on credit card debt costs

Benefits to Consumers

- Lower Interest Rates: Possibility of reduced interest rates on credit card balances

Risks to Consider

- Uncertainty: Factors influencing the relationship between inflation and credit card debt

By analyzing these trends, individuals can make informed decisions regarding their credit card debt management

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.