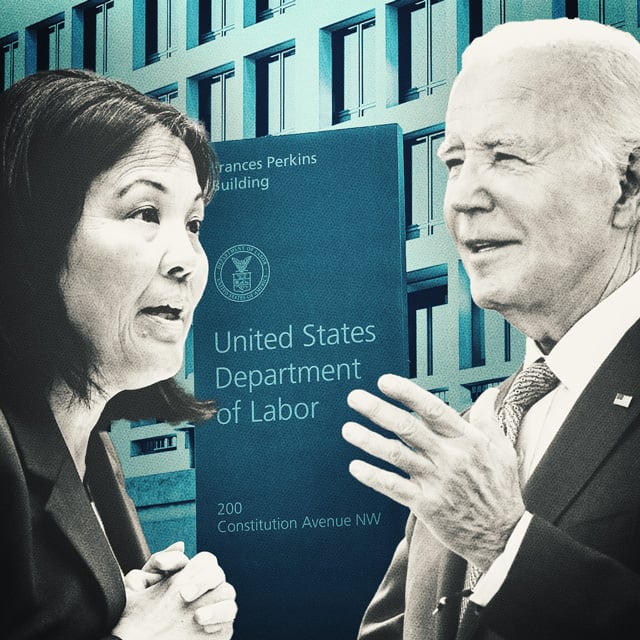

House Panel Advances Resolution to Repeal DOL Fiduciary Rule

Wednesday, 10 July 2024, 20:20

The House panel advances a resolution

The resolution aims to eliminate the DOL Fiduciary Rule, which had implications on the financial advisory industry.

Protecting retirement investors

The Rule mandated that financial advisors act in their clients' best interests, enhancing investor protection.

Impacting advisor practices

- The potential repeal sparks discussions on the regulatory oversight of advisors.

- Changes in practices could affect the options available for retirement investors.

The decision could lead to significant changes that impact both advisors and investors alike.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.