AMF Pension Fund's Strategic Shift in EV Portfolio Allocation

AMF Pension Fund's Portfolio Adjustment

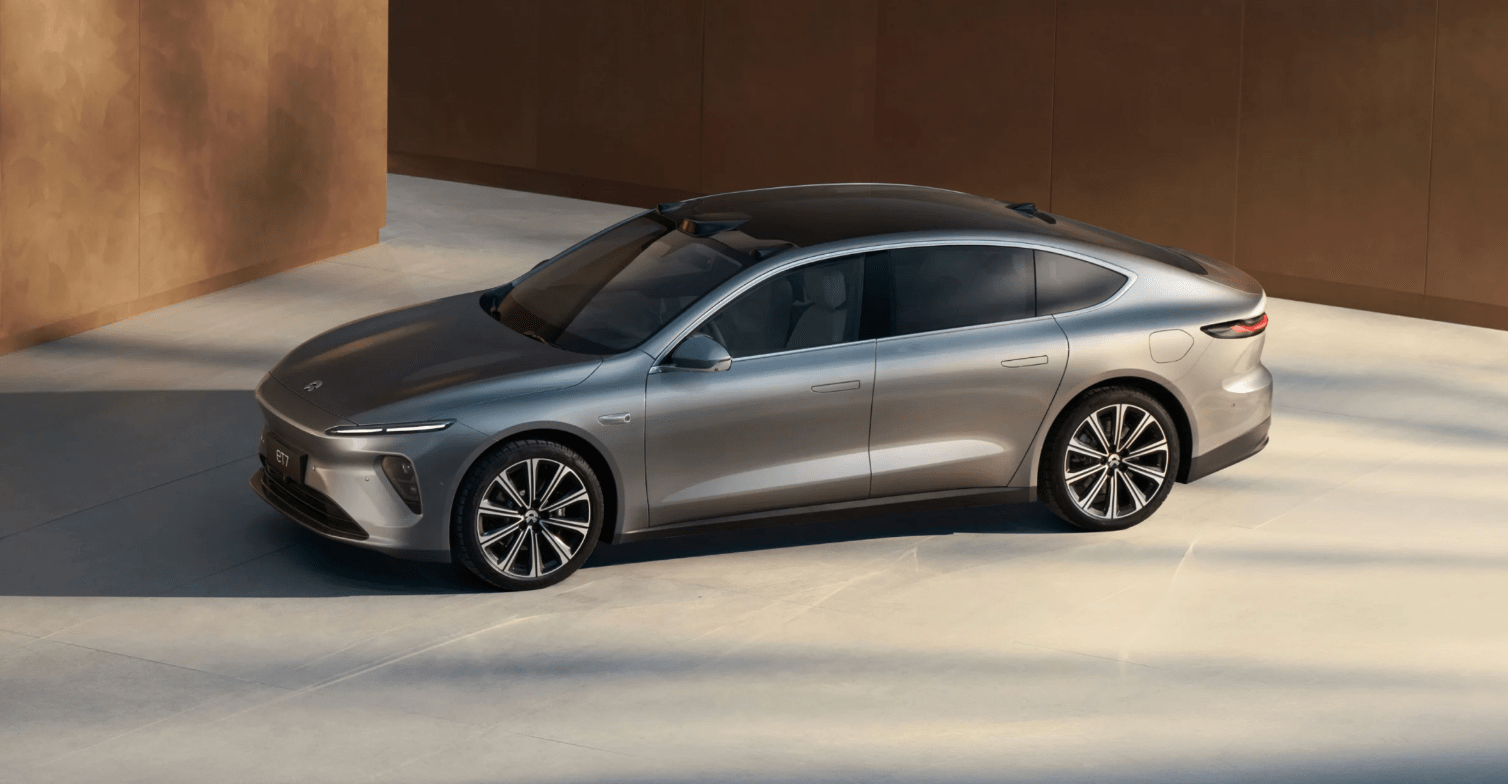

Sweden's third largest pension fund, AMF Pensionsforsakring AB, made a significant move by selling 562,700 shares of Nio, a leading electric vehicle manufacturer, to acquire Polestar shares. This strategic decision underscores the fund's focus on diversification and potential growth opportunities in the EV industry.

Portfolio Diversification Strategy

In a form filed on Wednesday, AMF Pension Fund revealed its strategy to optimize portfolio performance by rebalancing its EV holdings. By reducing exposure to Nio and adding Polestar shares, the fund aims to enhance long-term returns and mitigate potential risks in the evolving electric vehicle market.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.