Unveiling Apple Inc's True Worth through the GuruFocus DCF Analysis

Discovering Apple Inc's Intrinsic Value

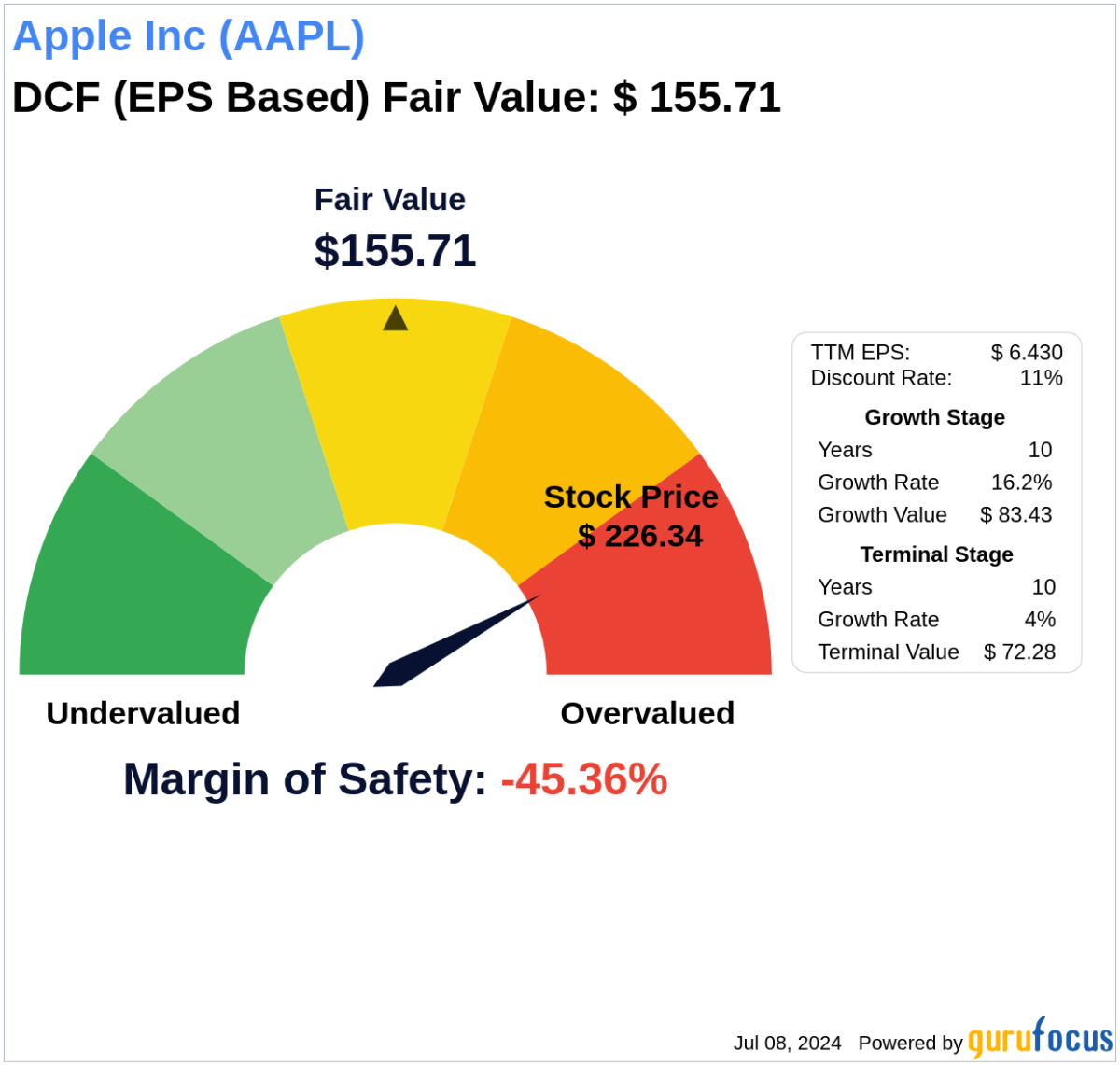

In this article, we delve into the intricacies of Apple Inc's valuation through the GuruFocus DCF method.

Data-Driven Insights

The analysis focuses on EPS calculations as a key determinant of intrinsic value, emphasizing its significance over traditional free cash flow models.

- Reliable Approach: The GuruFocus DCF calculator provides a comprehensive outlook on Apple Inc's true worth.

- Earnings vs. Cash Flow: Historical data supports the correlation between earnings and stock prices, shaping a more accurate valuation metric.

By adopting this approach, investors gain a nuanced understanding of Apple Inc's financial standing, aiding decision-making and long-term strategy development.

This article was prepared using information from open sources in accordance with the principles of Ethical Policy. The editorial team is not responsible for absolute accuracy, as it relies on data from the sources referenced.